Tesla’s share price: what to expect from Q4 results

Tesla’s share price: what to expect from Q4 results

When is Tesla reporting?

It’s expected to get volatile for Tesla’s share price on Thursday, January 25th at 8am (AEDT) after market close, as that’s when they’ll be releasing their fourth-quarter results.

Analysing Tesla's Q3: a disappointment

It wasn’t a pretty picture last time around, as third-quarter results were a miss on both earnings and revenue and came with added caution on the Cybertruck’s potential (or lack thereof) to deliver significant short-term positive cashflow.

Breaking down Tesla's Q4 production and deliveries

Looking beyond these challenges and breaking down deliveries and production for the final quarter of 2023, it was a record. Deliveries totalled over 484,000 with production nearly reaching 495,000. Overall, Tesla produced 1.846 million and delivered just under 1.81 million vehicles. While these figures were above 2022’s 1.37 million and within the October guidance of 1.8 million, they fell short of its earlier 2023 goal of two million.

The breakdown for the final quarter of 2023 showed that nearly 477,000 Model 3/Y vehicles were produced and over 461,000 were delivered. Meanwhile, “Other Models” accounted for 18,200 (3.8% of the total) and 23,000 respectively.

Tesla’s eventful quarter

This quarter saw Chinese rival BYD, with its lower-priced models, overtake Tesla as the world's largest producer of electric vehicles. Elon Musk, however, argues that Tesla is “an AI/robotics company that appears to many to be a car company,” suggesting it shouldn't be directly compared to traditional car manufacturers.

The quarter was also busy on other front including:

- Troubles in Scandinavia, which, however, didn’t seem to dent its sales in the region

- Mixed numbers in other areas, with testing in Germany and the UK but strong performance in China, reporting a 69% increase year-on-year for December according to the CPCA (China Passenger Car Association)

- The Cybertruck release

- A Model 3 refresh for some markets, which is considered necessary as the lineup, aside from recent releases, has aged significantly

- Further progress on the charging port adoption front, with its massive network of chargers

- Recalls, which are not uncommon among automakers and for Tesla only required an over-the-air software update

- Price cuts, with the average being lowered again during the fourth quarter (cargurus.com).

And then came more at the start of this quarter with rising labor costs, further price cuts, and supply chain woes on recent geopolitical factors. Investors are expected to take note of these issues and any further updates on the low-cost model, which is reportedly “quite far advanced” and targets the mass market with a lower price point, unlike the Cybertruck.

Key points of interest include Tesla's guidance for 2024 in light of subsidy and tax credit reductions/removals, potential further price cuts this year to sustain growth, the impact on profit margins, and plans for geographic expansion. All these factors are in the context of anticipated rate cuts this year, which might ease what was expected to be a “stormy” macroeconomic situation.

EPS and revenue forecasts

In all, expectations for the fourth quarter indicate an earnings per share (EPS) of $0.74. This figure is lower both quarter-on-quarter and year-on-year. Revenue is anticipated to be stronger, rising to $25.5 billion, with growth expected across all key segments. Although margins are likely to remain tested relative to figures prior to 2023, they are predicted to improve to around 18%, up from 17.89% in Q3 (source: Refinitiv).

As for analyst recommendations, there are five in the ‘strong buy’ category, 12 ‘buy’, 19 ‘hold’, and four for both ‘sell’ and ‘strong sell’. The average price target among these analysts has only recently surpassed its falling share price (source: Refinitiv).

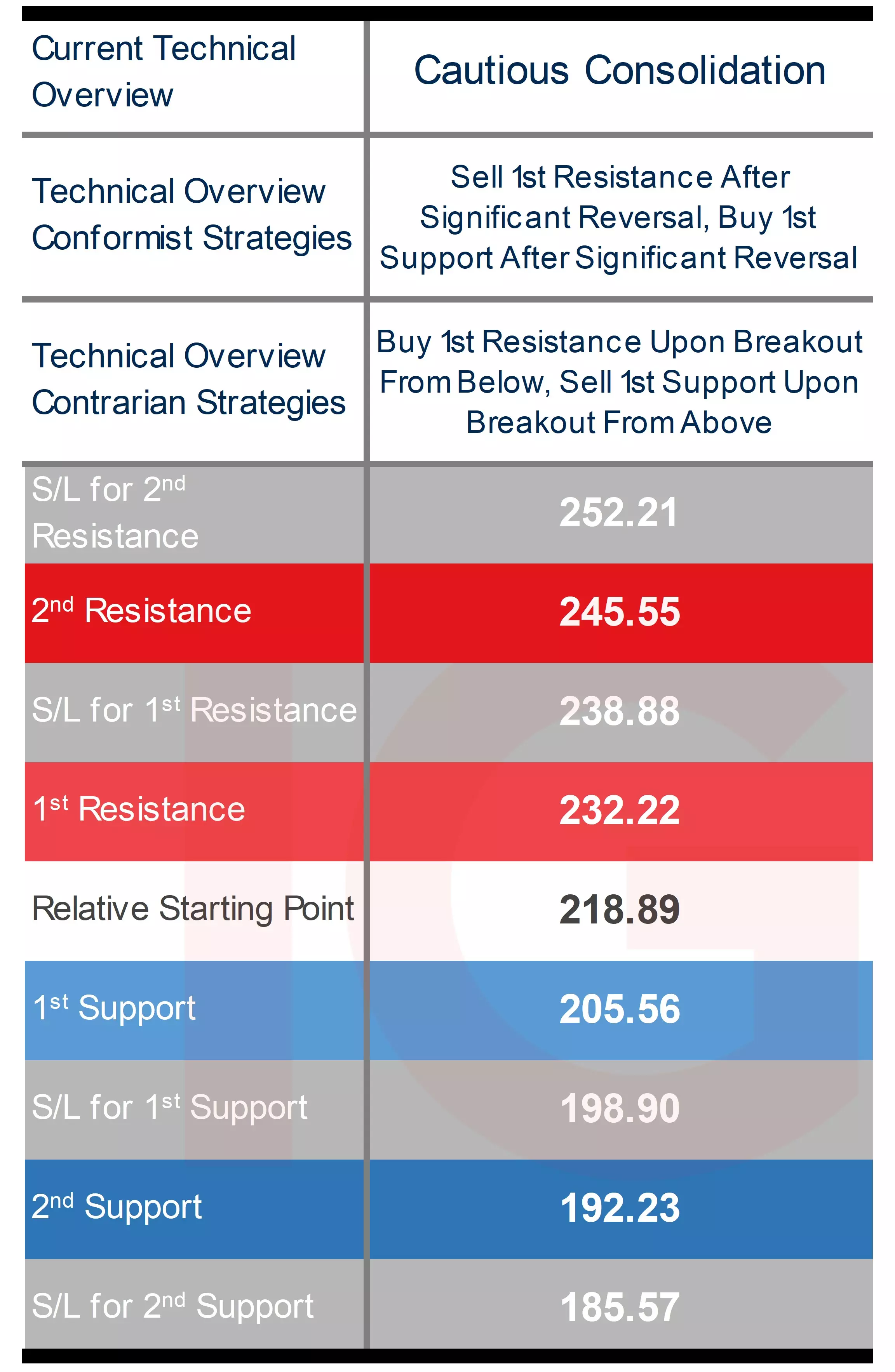

Trading Tesla’s Q4 results: weekly technical overview and trading strategies

There’s no denying the strength of 2023 for the ‘magnificent seven’, with Tesla notably outperforming among them (Nvidia +233%, Meta +188%, Tesla +109%, Amazon +78%, Alphabet +57%, Microsoft +55%, Apple +48%). However, these gains were primarily realized in the first half of the year, with Tesla's share price starting to be tested after mid-July.

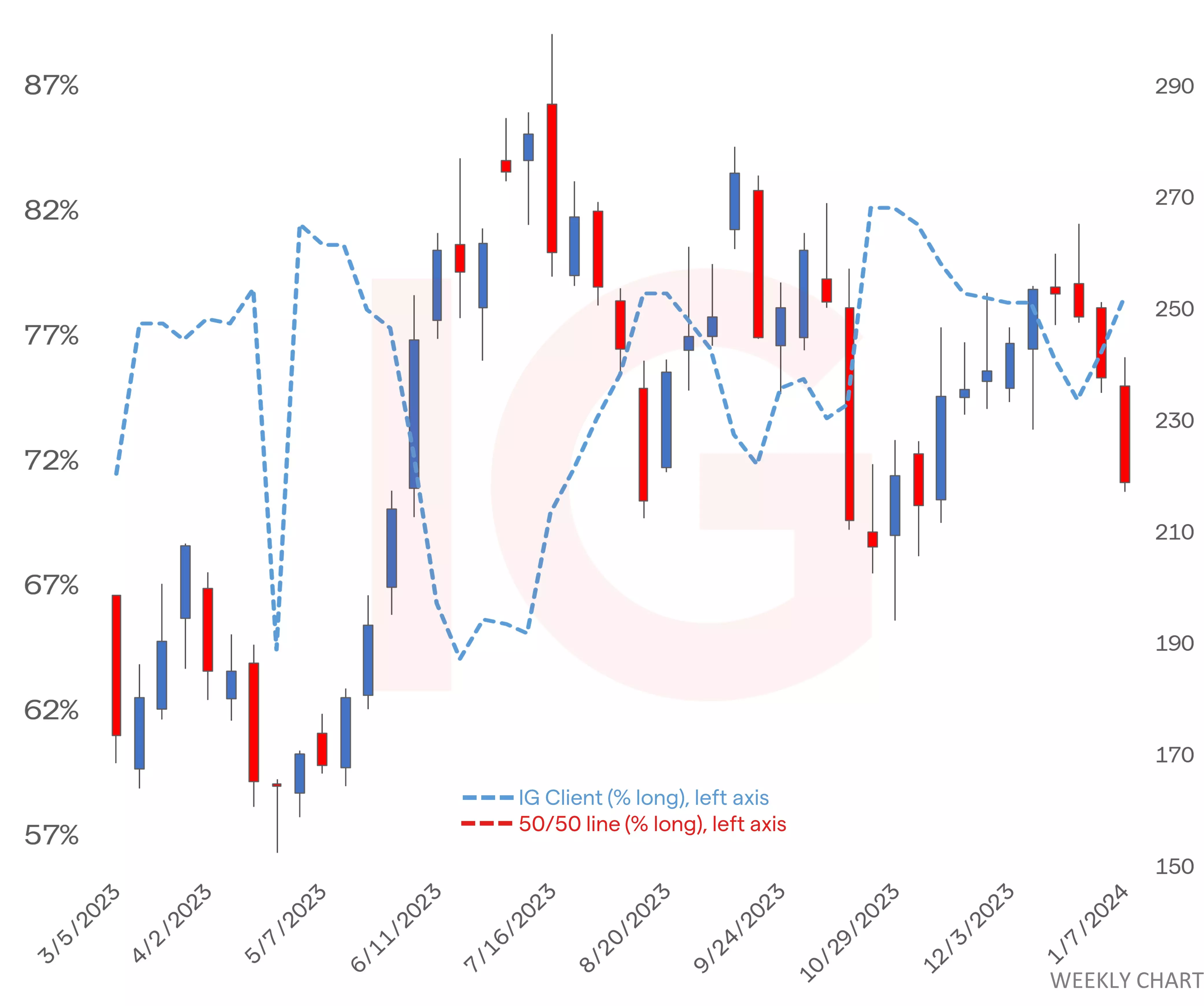

The technical overview on the shorter-term daily timeframe was more positive when the price managed to remain within its bull channel. The break below this channel at the start of this year disrupted its key technical indicators. This included a negative DMI (Directional Movement Index) cross and the price falling below all its main short and long-term daily moving averages.

When we zoom out to the weekly timeframe, while the same negative cross has occurred, the proximity of price-indicator and indicator-indicator relationships has made it difficult to gain clear insights on the technical front, given the ease with which they can generate signals on a not-so-significant move.

This has led to a more cautious overview at this stage, despite the negative technical bias, with most weeks showing relatively controlled intraweek moves. It's important to note that the earnings release is a fundamental event where technical analysis is less relevant, particularly if there's a surprise. This means technical levels will likely struggle, or even fail, to hold once the latest figures are released.

Conformists should approach with added caution, avoiding fading any move towards 1st levels and maintaining that caution even when approaching 2nd levels. Contrarian breakout strategies may see added follow-through if the price has already neared these levels just before the event.

Source: IG

Source: IG

Tesla weekly chart with key technical indicators

Source: IG

Source: IG

Tesla weekly chart with IG client sentiment

Source: IG

Source: IG

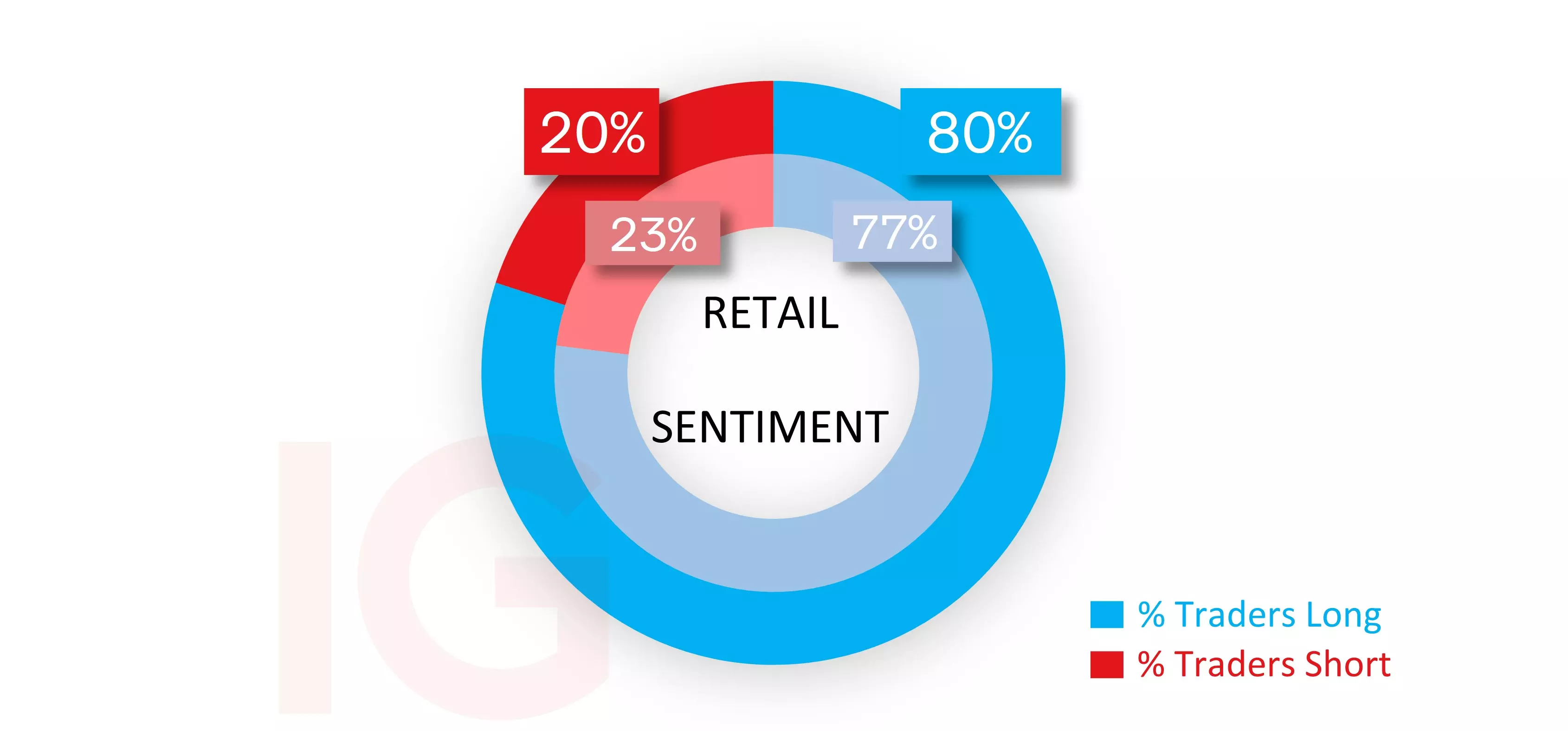

IG client sentiment* and short interest for Tesla shares

In terms of sentiment among IG clients, there has been a consistent trend of heavy to extreme buy bias for several months. This bias saw some unwinding when the price reached the upper end of the channel, and increased again following the recent price pullback. Starting last week at 77%, the bias has escalated to 80% at the beginning of this week after a red weekly close.

Short interest has remained relatively stable in recent months, briefly exceeding 92 million shares in November. The most current data indicates over 86 million shares in short interest, accounting for 2.73% of the total (source: Refinitiv).

Source: IG

Source: IG

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of the start of the week for the outer circle. Inner circle is from the start of the previous week.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now