The safe haven appeal of gold amidst rising geopolitical risks in 2024

Explore how gold outperformed other commodities in 2023 and what investors can expect in 2024 amidst economic uncertainties and geopolitical tensions.

Source: Bloomberg

Source: Bloomberg

Tom Bailey, Head of ETF Research at HANetf

Gold's stellar performance in 2023

Gold showcased remarkable resilience in 2023, surpassing expectations in a high-interest-rate environment and outperforming commodities, bonds, and global equities (excluding US stocks). Before examining the prospects of the yellow metal in 2024, let's first understand the investment case for gold and its key price drivers.

The unique appeal of gold

Gold is a unique asset class. During periods of economic uncertainty, investment demand for a safe-haven asset drives gold prices. At the same time, during periods of economic expansion, pro-cyclical consumer demand can support gold price performance. These two factors give gold the ability to provide stability in a range of economic environments. Most other commodities typically do not have this unique profile.

We can divide gold demand into three categories:

- Economic expansion: positive for gold consumption as an expanding economy increases demand for jewellery and electronics

- Risk and uncertainty: gold tends to shine in times of heightened risk and uncertainty, attracting investors seeking a safe haven

- Opportunity cost: gold faces headwinds when bonds provide higher yields, and tailwinds when bonds provide lower yields.

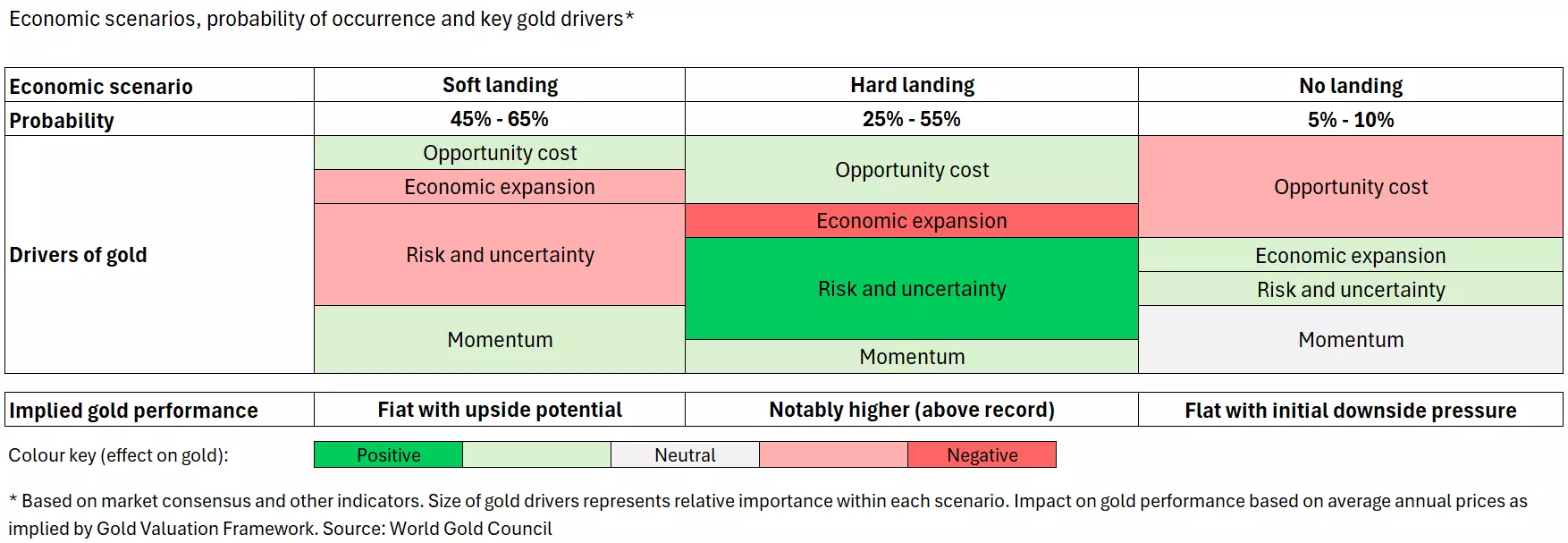

2024 outlook: the US economy's impact on gold

The first factor to consider for gold’s outlook, therefore, is the outlook for the US economy. Gold’s fortunes in 2024 will partially depend on whether the US economy achieves a soft landing, hard landing, or no landing. In its latest outlook, the World Gold Council detailed which aspects of gold demand will be positive or negative in the three potential economic scenarios, as shown in the table below.

The global economy faces three likely scenarios in 2024

Source: World Gold Council

Source: World Gold Council

The dynamics of a soft landing

A soft landing is now widely expected, meaning the opportunity cost becomes a potential driver of gold prices. In such a scenario, the Federal Reserve will be in a position to cut interest rates and bring down US bond yields. That makes gold, a non-income producing asset, relatively more appealing. However, such a scenario could potentially detract from gold prices as risk and uncertainty recede, meaning less demand for gold as a safe-haven asset.

Balancing act: risk vs. reward in gold investment

According to the World Gold Council, these two competing factors may balance each other out, with gold prices potentially flat, assuming a soft landing is achieved. But, as the World Gold Council also notes, there is some upside potential. That potential upside, we believe, could come in the form of geopolitical risk.

A geopolitically unstable world

While investors have always considered geopolitical risk, the urgency was less in recent decades. As academic studies have shown, the end of the Cold War marked a more benign geopolitical environment, with conflicts declining.

However, this benign geopolitical environment, many fear, may now be coming to a close. With the global order potentially in flux, there is a sense that the world is now beset by growing tensions between major powers and, with it, greater risk of geopolitical shocks.

Gold: a safe haven amidst global uncertainty

Gold is a potential hedge against geopolitical shocks. This was exemplified by the outbreak of the Israel-Hamas conflict in 2023. Between 3% and 6% was added to gold's overall performance in that year, according to the World Gold Council. Historical data shows that gold has a strong correlation with geopolitical risk. As Mark Rosenberg, founder and CEO of GeoQuant notes, gold has a strong correlation with the GeoQuant Global Political Risk Index, sitting at around 0.72.

Correlations (day-on-day): 1 Jan 2017-7 Dec 2020

Source: Correlations (day/day) between GeoQuant geopolitical risk indicators

Source: Correlations (day/day) between GeoQuant geopolitical risk indicators

Election year uncertainties: gold's role amid political risks

2024 is also a year marked by major global elections, including those in the US, the EU, and India. The current US election poses a notable political risk to investors, with the prospects of Donald Trump's return to the White House or disputes over the validity of the election. As data from GeoQuant shows, US political risk is also very tightly correlated with gold.

The geopolitical case for gold in a shifting world order

But the current geopolitical environment adds a longer-term potential case for holding gold. Following Russia's invasion of Ukraine, the US responded with robust sanctions, leveraging the central role of the US dollar to the global financial system. Some have accused the US of "weaponising" the US dollar.

This, some argue, risks chipping away at the US dollar's global reserve status, as countries decide to diversify away from the dollar. Economic historian Barry Eichengreen has warned that the more the US uses the dollar to pursue its geopolitical interests, "the stronger the incentive for governments to invest in alternatives, and the faster the movement will be."

As a result, following sanctions on Russia in 2022, there has been growing talk of de-dollarisation. This has been spearheaded by Russia and China, alongside some members of the BRICS Group.

While the prospect of another currency replacing the global dominance of the US dollar looks unlikely, it is an added risk to consider in the face of geopolitical shocks and a world of increased international tensions. Gold, therefore, offers a potential hedge against this.

Central Banks and the rush to gold amid currency concerns

Indeed, in the absence of any other contender for reserve currency status, countries diversifying away from the dollar have opted for gold. Accordingly, central banks have been buying gold at record rates in recent years, with the People's Bank of China leading the way.

Potential geopolitical shocks, therefore, may further add to this sense of de-dollarisation, particularly if such shocks come in the form of growing US-China tensions. This will potentially be constructive for gold prices, adding to its appeal as a hedge.

Is inflation defeated? The enduring value of gold

Longer term, the case for gold as an inflation hedge should still be considered. The world's major economies have made significant progress in bringing down the inflation spikes experienced in 2021 and 2022. But are we now set to return to the low inflation environment of the past 30 years? There are reasons to believe not.

After all, a key driver of lower inflation was globalisation, with the entry of China and former Communist countries into the global economy in the 1990s. We are now potentially faced with a period of deglobalisation, with terms such as "reshoring" or "friendshoring" growing in popularity. Related to this, we have seen a return to industrial policy, such as with the US' Inflation Reduction Act. Such policies have the potential to be inflationary. So, if such an outlook is correct, gold and other commodities offer the potential to act as a store of value while inflation erodes the value of paper currency.

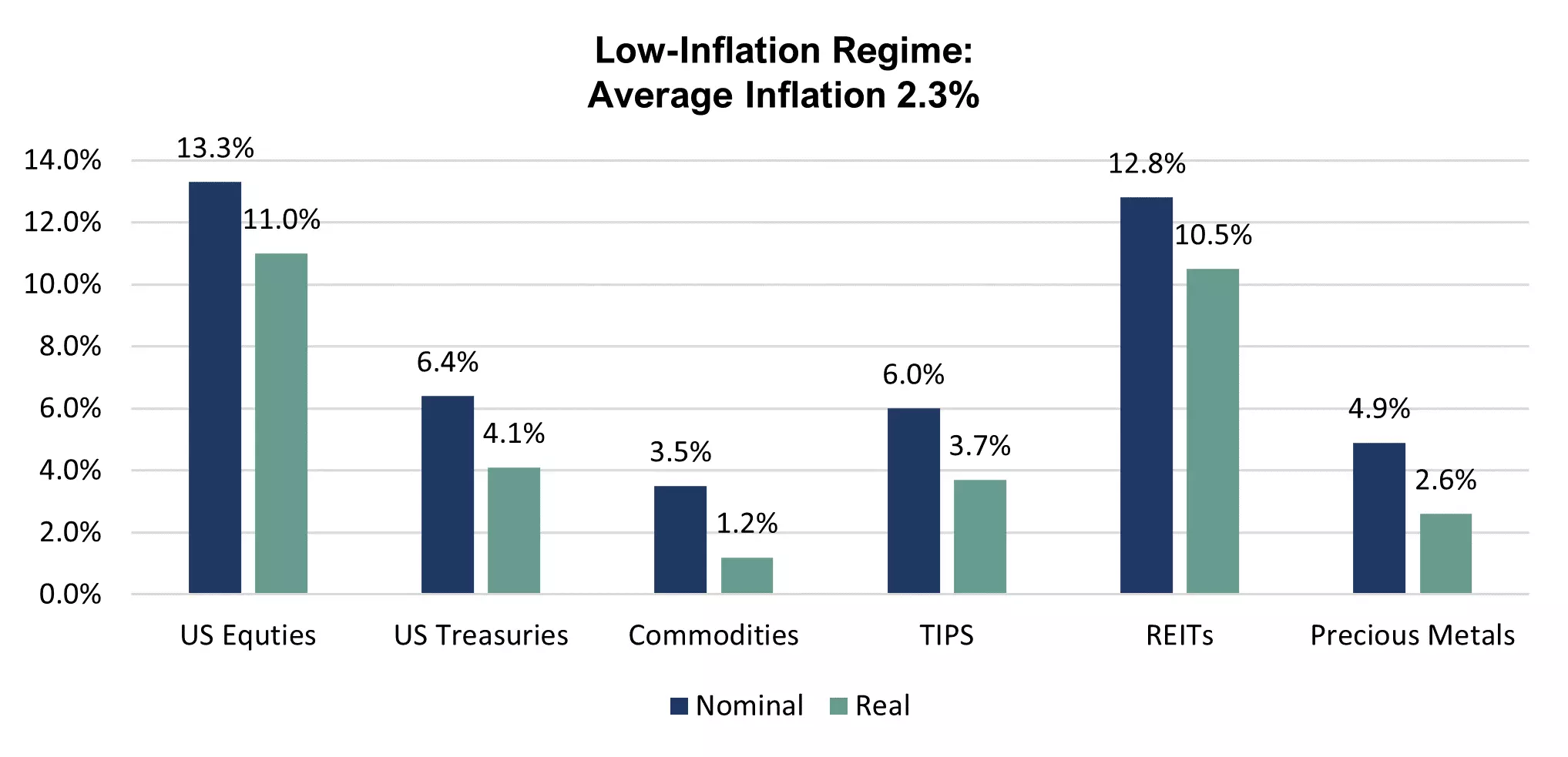

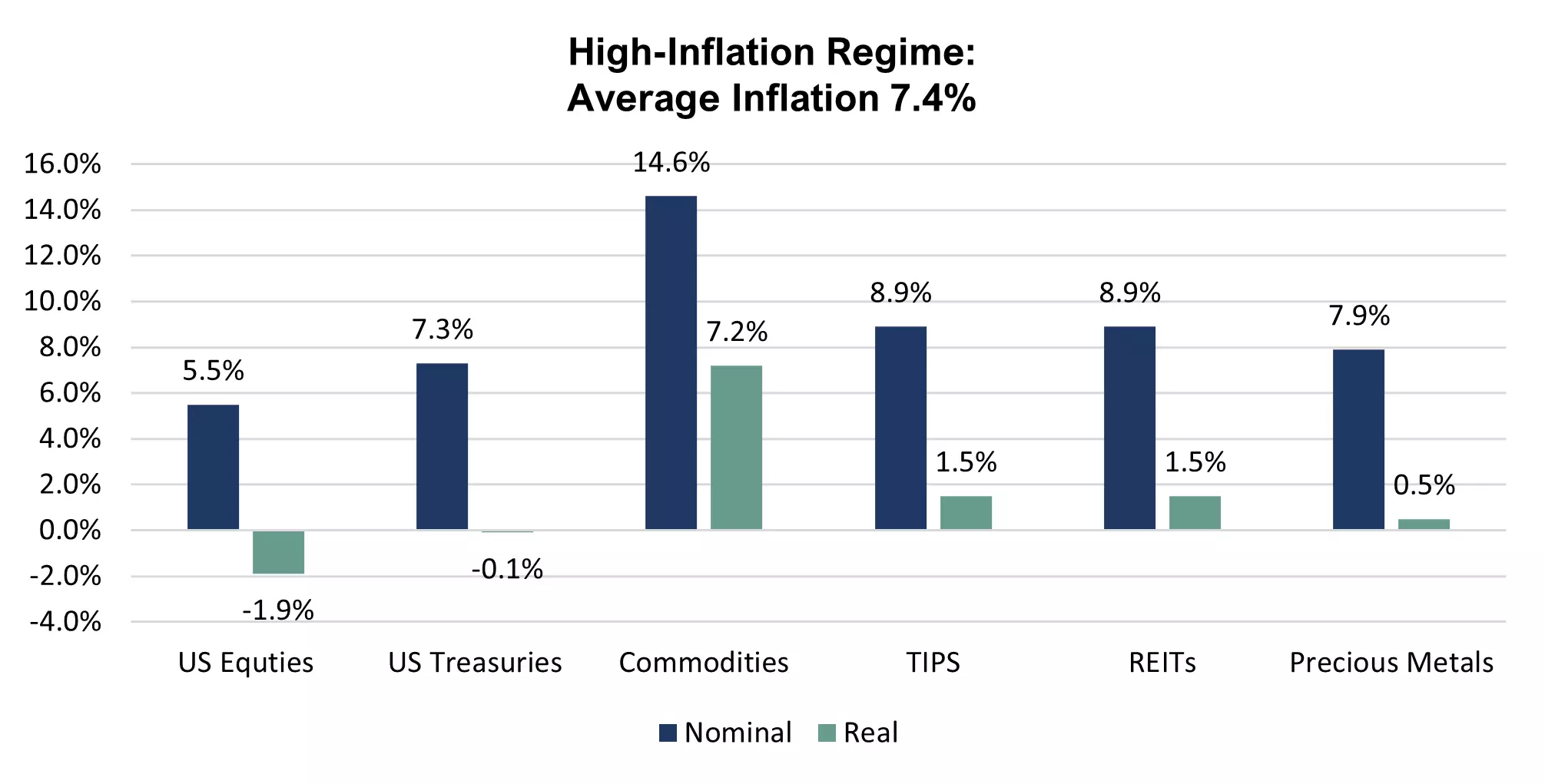

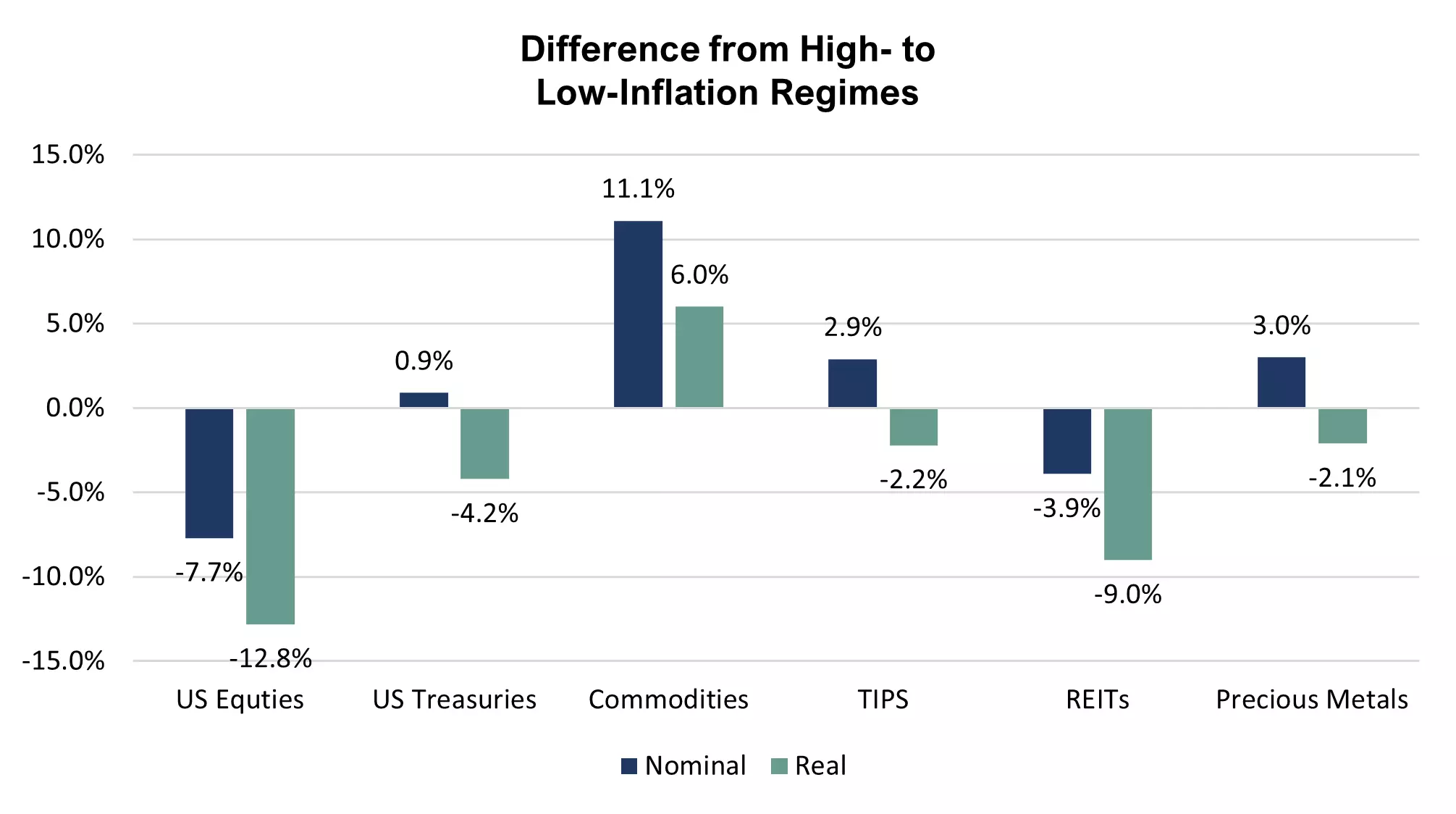

Gold's resilience in high inflation: a historical perspective

According to research from PGIM, while higher inflation periods proved challenging for equities and bonds, they have been positive for precious metals such as gold. PGIM's research paper 'Portfolio Implications of a Higher US Inflation Regime' compared returns of different asset classes in periods between 1973 and 2021 when inflation was above 4%. During such "high inflation regimes", real returns for stocks and bonds were negative while real returns for precious metals were positive.

During the 1973-2021 timeframe, across the periods of high inflation, the average inflation rate was 7.4%. Over those periods, precious metals returned, in nominal terms, 7.9%, and in real terms, 0.5%. If we are due a period of structurally higher inflation, gold is a potentially attractive asset class.

Historical return outcomes in low- and high-inflation regimes Q2 1973 – Q4 2021

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

Source: Datastream; Bloomberg; FactSet; PGIM Quantitative Solutions. Data as of 31.12.2021.

How to gain exposure to gold?

Investors looking for gold exposure may wish to consider the Royal Mint Responsibly Sourced Physical Gold ETC (RMAU). This ETC was the first financial product to be sponsored by the Royal Mint and the first gold ETC to be launched in partnership with a European Sovereign Mint.

All the gold within the ETC is custodied at the Mint rather than a bank's vault. Uniquely, retail investors can redeem for physical bars and coins, adding to its appeal as a safe-haven asset. Crucially, all the bars are London Bullion Market Association (LBMA) post-2019 responsibly sourced good delivery bars – the highest standard available.

A green twist: recycled gold bars

The ETC was also the first gold ETC to introduce recycled gold bars. Recycled gold is less carbon-intensive than mined gold, adding to its sustainable appeal.

Alternatively, investors may wish to consider gold mining stocks. Typically, in a bull market for gold, mining stocks have outperformed the price of the commodity itself.

ESG-focused gold mining investments

The AuAg ESG Gold Mining UCITS ETF (ESGO) offers exposure to an equal-weighted basket of 25 ESG-screened companies that are active in the gold mining industry. The gold mining ETF tracks the Solactive AuAg ESG Gold Mining Index, which focuses on companies that have low ESG risk characteristics.

The fund uses Sustainalytics to screen the mining universe for their ESG credentials, attributing a risk score based on their findings. Only the top 25 companies with the lowest ESG risk are included within the index.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now