USD Risks Remain to the Upside Despite Inflation Induced Dip

USD Price Analysis & News

- Inflation Induced USD Dip to be Faded

- USD and US Yields to Face Upward Pressure into Jackson Hole

Yesterday’s inflation report marked a win for team transitory with factors such as used cars peaking. However, while the release prompted a marginal turnaround for the greenback, given Fed members are largely in agreement that the inflation goal for tapering has been met, the focus is on the labour market and thus the inflation report should have little consequence for the direction of the greenback.

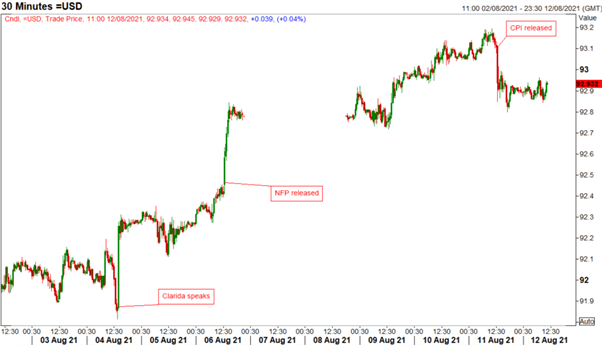

That being said, US yields are only slightly below the pre-CPI high, which is also despite a very strong 10yr auction. As such, heading into the Jackson Hole Symposium, which I believe will be the time at which Chair Powell provides a taper signal well in advance (3-months) of the actual taper, US yields and by extension the USD index can continue higher. Keep in mind, that this recent pullback in the greenback is the first opportunity for dip buyers to enter since the more hawkish than expected Clarida comments and the strong NFP report. In addition to this, Fed Officials from here on in are likely to discuss that the time is nearing for the Fed to taper, maintain upward pressure on yields into JH.

USD Chart: 30-Minute Timeframe

Source: Refinitiv

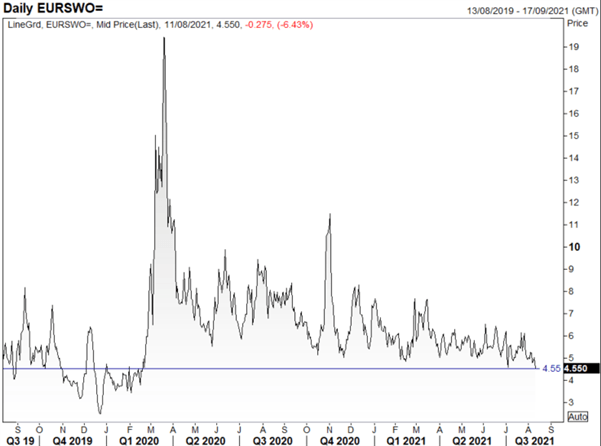

With FX markets lacking any real direction, it is fair to say the summer lull has most definitely kicked in, encapsulated by EUR/USD 1W vols falling to fresh YTD lows. It is times like that these where market participants who overtrade are better off sitting on the hands as opposed to jumping in a position out of sheer boredom, or better yet, using the downtime to read one of our educational pieces on market psychology.

Top 10 Trading Myths: Guest Commentary

EUR/USD 1W Volatility

Source: Refinitiv

The economic calendar suggests that the morning lull is set to continue into the US trading session with little in the way of notable data points. That said, sizeable option expiries will be worth keeping an eye given that they can at times magnetise price action.

Major Option Expiries

EUR/USD: 1.1700-05 (1.7bln), 1.1775-90 (1.6bln), 1.1795-00 (1.6bln)GBP/USD: 1.3850-60 (785mln)EUR/GBP: 0.8450 (1.1bln), 0.8500 (650mln)USD/CAD: 1.2495-1.2500 (1.6bln)USD/JPY: 110.30-35 (1.4bln)

Source: Refinitiv, DTCC

Written by Justin McQueen, Strategist, 12th August 2021. DailyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now