What comes next for crude oil following the outbreak of hostilities in the Middle East?

As violence erupts in the Middle East, markets grapple with uncertainty, and crude oil prices surge.

Source: Bloomberg

Source: Bloomberg

Navigating market uncertainty amid Middle East turmoil

In the wake of escalating violence in the Middle East, we join the global community in extending our heartfelt prayers and hopes for a swift end to the outbreak of horrific violence. Financial markets, meanwhile, are bracing for volatility, as investors attempt to gauge the ripple effects of the conflict on diverse asset classes.

Our previous analysis highlighted two probable trajectories for the conflict. The first confines the hostilities within existing borders, while the second envisions a regional flare-up affecting multiple sectors of the global investment landscape.

In either scenario, the foreseeable consequence is a surge in crude oil prices, although the magnitude will vary depending on geopolitical developments.

US foreign policy and crude oil market dynamics

Rewinding the clock to the Trump administration, Iranian oil exports plummeted to under 500,000 barrels per day. However, with the Biden administration's more lenient stance, Iranian oil exports rebounded to approximately 1.5 million barrels per day, providing some relief to the sky-high energy prices.

Post-Hamas surprise offensive, Israel is likely to advocate for the United States to reimpose sanctions on Iran.

The ripple effect? A predictable uptick in crude oil prices, both in the short-term and potentially the long-term, as sanctions cripple Iran's oil infrastructure investment and maintenance.

Sourcing alternatives to Iranian crude

The US may request other oil-producing nations to increase supply to counter the loss of Iranian exports. However, given that the US has strained relations with Saudi Arabia and Russia, the ability to source and offset the loss of Iranian crude oil appears limited.

Crude oil technical analysis

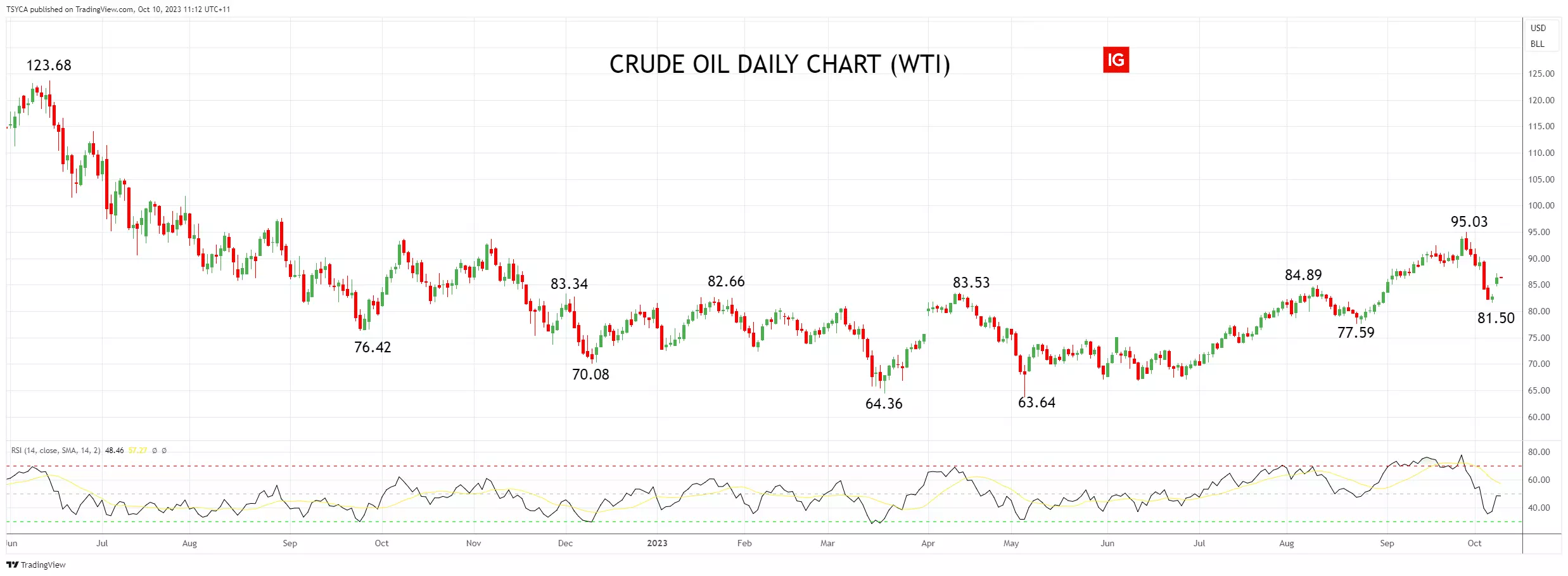

After spending almost ten months trading within a range above $63.00 and below $84.00, crude oil surged higher to $95.00 at the end of last month in response to production cuts by the Saudis and Russians. The rally was halted as the relentless rise in long-term yields and tightening financial conditions into the end of September prompted a 14% pullback to last week's low of $81.50.

Assuming crude oil holds above last week's $81.50 low, we anticipate crude oil to move higher toward $90, with potential upside risks toward the September high of $95.03.

Crude oil daily chart

Source: TradingView

Source: TradingView

- TradingView: the figures stated are as of 10 October, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now