Outlook 2024: Will the upward trend in USD/JPY reverse?

With bets that the Fed’s hiking cycle has peaked, alongside a series of rate cuts priced through 2024, the USD/JPY has touched its two-month low this week.

Source: Bloomberg

Source: Bloomberg

Fed-BoJ policy divergence may be set to reverse in 2024

The USD/JPY had a stellar run through the bulk of this year, with the pair taking its cue from the widening US-Japan bond yield differentials, as a result of monetary policies’ divergence between both central banks. But with recent bets that the Federal Reserve (Fed)'s hiking cycle has peaked, alongside 125 basis point (bp) worth of rate cuts priced through 2024, the 10-year bond yield differentials have since narrowed significantly from its peak of 4.148% to the current 3.412%, paving the way for USD/JPY to touch its two-month low this week.

Source: TradingView

Source: TradingView

As we head into 2024, the policy-divergence story may be set to reverse further if inflation in the US continues to move in line with its current trend – a gradual moderation in pricing pressures. US economic conditions have also turned in softer in recent months, revealing a lesser extent of outperformance compared to months earlier, which provides validation to the dovish market views on the Fed’s policy outlook.

On the other hand, the Bank of Japan (BoJ) has been heading the other way, taking intermittent (though, minor) steps towards policy normalisation this year while talking up the need to shift away from its current ultra-accommodative policies. While the recent plunge in oil prices and still-subdued wage growth may allow the BoJ room to exercise more patience in its policy pivot, an exit from its negative interest rate policy (NIRP) seems to remain a matter of when and not if. Current market rate pricing has anchored it down to be by the second quarter (2Q) of 2024.

Source: Refinitiv

Source: Refinitiv

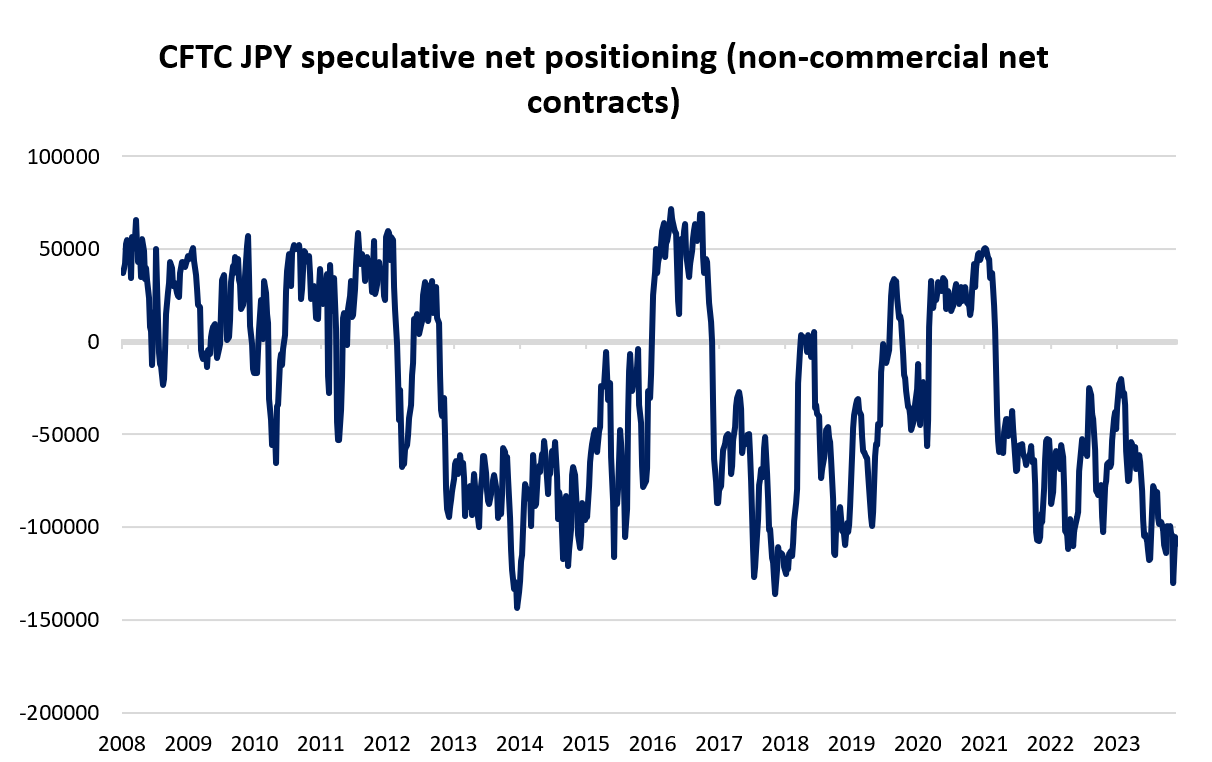

Still extreme bearish yen-positioning may offer room for unwinding

From the Commodity Futures Trading Commission (CFTC) data, speculative net-short positioning in the Japanese yen continues to hover near its extreme last week, briefly touching its highest net-short levels in five years during mid-November this year. The extreme-bearish take among speculators may offer room for potential short-squeeze opportunities into 2024, if hawkish expectations for the BoJ were to be validated.

Source: Refinitiv

Source: Refinitiv

Technical analysis: USD/JPY eyeing a break of critical support

For the USD/JPY, multiple retests of the 152.00 level in November this year have failed to find the conviction to push to a new decades-high. The pair has retraced 3.7% from its recent top to a crucial level of support at the 146.74 level, where a well-respected lower channel trendline support since the start of the year stands in place. The bears may attempt to strive for a breakdown of this level next, which may unlock further downside towards the 145.00 level, where its 200-day moving average (MA) lies.

Recent downside has also marked a breakdown of its Ichimoku cloud support on the daily chart for the first time since April 2023, while its daily relative strength index (RSI) has dipped below the key 50 level for the first time in four months as well, both reflecting some near-term bearish momentum at play. Should the bulls manage to defend the lower channel support trendline, they may face immediate resistance at the 149.20 level, where its 100-day MA stands alongside the lower edge of its daily Ichimoku cloud.

Source: IG charts

Source: IG charts

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now