-

Posts

13,207 -

Joined

-

Last visited

-

Days Won

556

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Caseynotes

-

-

3 hours ago, dmedin said:

Not looking good right now.

lol, are you really sure you're cut out for 'buy and hold'?

-

2 hours ago, HPbrand said:

The time may have come for a proper correction. Those spending weeks or even months shorting the US markets may finally triumph for once.

true, pullbacks and corrections are part of the natural market cycle but in a strong uptrend they should really be viewed as an opportunity to get long or add on long and keep doing that until it stops working which will be the first sign the trend may well be over.

-

1

1

-

-

28 minutes ago, RCtrader said:

Does anyone here think it's a good idea to go short on USDCAD with TP at 1.3112? My H1 interactive chart

The question is do you think it's a good idea and why; usdcad shot up on the Cad rate decision and mon pol statement at 3pm and then gave it some more on the presser just after 4pm.

The big boys clearly thought the new information meant it was time to readjust their positions, the question is has there been any new news since to make them change their mind or maybe are they going to think they over did the rally and regretting it now so take some off? Because they are the only 2 reasons to presume price might reverse back down.

The other side is that price might well just consolidate here before continuing upward, especially given oil's continuing decline.

Personally I wouldn't be betting the big boys have got it wrong, and if oil continues down tomorrow usdcad could well continue up.

The point is you must come up with a valid reason as to why price might go up or down before taking a trade, currently the upside looks the stronger to me.

-

1

1

-

-

imagine spending 3 months trying to short that chart 😭🚑🛌

-

1

1

-

1

1

-

-

It makes you weep, it really does. 😭

-

1

1

-

1

1

-

-

-

1

1

-

1

1

-

-

Oh dear, looks like Bernie is getting stitched up second time in a row, even Trump has noticed it.

Clinton to say in interview no one likes him, no one wants to work with him. Warren accuses Bernie of calling her a liar on national tv.

-

13 minutes ago, dmedin said:

The bans on specific flavours of vape are ridiculous. Hopefully those regulations get overturned 😎

Don't forget cannabis! Vaping is a lot cleaner and easier than trying to roll up a doobie

Because vaping is such an effective way to administer a drug, hospitals have been using it for decades to not only deliver drugs but also to treat lung disease. People have started producing class A drugs that have been altered to be used in a vape device but with little understanding or control of dosages. When users turn up in A+E they forget to mention the class A bit for some reason and just report they were vaping. 🚑🤨

-

1

1

-

-

-

Actually vaping looks set to take off again with the US starting to realise the health issues including some deaths associated with vaping in the US recently stem from it being used ad hoc to administer all types of illegal drugs and not anything to do with the device or the basic sugar water and flavourings that is vape juice.

It's effectiveness at aiding people getting off tar filled cigarettes is second to none and given that some 70% of Chinese and south east Asian males still smoke would indicate massive untapped markets for vape devices and associated products world wide.

-

2

2

-

-

Just now, dmedin said:

Looks like a sci-fi tornado or some kind of whirling vortex in outer space 😎

And you're still using trendlines, sheesh. 🙄

-

1

1

-

-

Interesting graphic IG have just used. Looks like a 2 Relative Rotation Graphs of Ftse winner/ losers.

-

1

1

-

-

On 31/12/2019 at 21:48, Chazza69 said:

Is it just me or have everybodys stops gone and cant be put back on limits for example profit/loss

I'm presuming this is on the demo platform?

-

-

1 minute ago, AndrejK said:

Apparantly USA ETF's are not allowed in ISA

Anyone know how to invest in the list bellow using an ISA?

ThanksXLE Energy Select Sector SPDR Fund

XLI Industrial Select Sector SPDR Fund

XLU Utilities Select Sector SPDR Fund

XLV Health Care Select Sector SPDR Fund

XLY Consumer Discretionary Select Sector SPDR Fund

XLB Materials Select Sector SPDR FundHi, the regulations regarding what is allowed in an ISA is not from IG but the government. See the IG ETF screener for ISA and non-ISA.

-

1 hour ago, liontrading44 said:

Hi, presumably you have just hit a patch of increased volatility and, as stated, price moved before the order could be completed, instead just passing on slippage or requoting the platform is saying to hit the buy/sell button again at the new price on the ticket if you still want to place the order.

-

2

2

-

-

-

8 hours ago, dmedin said:

I predict a pullback to 23.6% before resumption of uptrend

-

1

1

-

-

-

Markets shrugged the forth coming zombie apocalypse (has it already got them?). Dax and S&P into new highs, Dow heading that way and Ftse looking upward to monthly chart resistance (purple).

I read a report from China on Monday that said this new virus was not as bad as the SARs of a while back stats wise.

-

8 hours ago, dmedin said:

Boeing sinking probably did it for Wall Street ...

I predict a pullback to 23.6% before resumption of uptrend

Predictions and opinions, oh dear. 😳

-

-

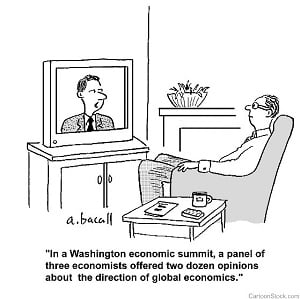

Have you ever wanted to be a sell-side economist? Here's 10 rules (tricks of the trade) you need to to master.

21 Jan 2020 - Dario Perkins1) Economic forecasts: Forecasting GDP is basically a waste of time - no investor actually cares what this backward-looking gauge of the economy is doing. But getting it "right" is one of the few (though dubious) ways you can signal your value as a sellside economist. In the old days you would pretend GDP reverted to some sort of trend but today you can just assume it stays close to whatever the current level is (usually 2% for the US). If you get your forecast wrong, you should blame “unseasonal” weather.

2) Game of two halves: Every year must be divided into two. If the economy is weak in the first half of the year, you should assume a recovery in the second half. If it is strong, assume a slowdown. Whatever makes the average of the two halves - there are always two halves - close to 2%.

3) Economic shocks: Whenever something unexpected happens, like extreme weather or a government shutdown, industrial action or trade tariffs, a financial journalist will always want to know what this means for the macro economy. You need an estimate that is high enough to matter, but not so large that it would force you to change your forecast or look obviously wrong within a few weeks. A good rule is that the event will add or subtract 0.3%pts from GDP. After all, this is invariably the answer you get from sophisticated econometric models (the economists who created these models obviously caught onto this idea long before anyone else).

4) Recession watch: History shows nobody can forecast recessions. Even those that do typically benefit from the ‘stopped-clock’ effect and usually get the causes of the recession totally wrong (see Dr Doom circa 2006). But you can’t admit this to investors and you certainly don’t want to get caught out by a downturn, especially when a lot of time has elapsed since the last recession. So the best approach is to emphasise the dangers of recession but claim this is at least 18 months away. If it happens sooner, you can say you correctly warned about the dangers. If there is no recession you can simply postpone your forecast and hope nobody remembers.

5) How to get attention: If you want to get famous for making big non-consensus calls, without the danger of looking like a muppet, you should adopt ‘the 40% rule’. Basically you can forecast whatever you want with a probability of 40%. Greece to quit the euro? Maybe! Trump to fire Powell and hire his daughter as the new Fed chair? Never say never! 40% means the odds will be greater than anyone else is saying, which is why your clients need to listen to your warning, but also that they shouldn’t be too surprised if, you know, the extreme event doesn’t actually happen.

6) Central-bank watching. For the most part central banks will tell you exactly what they are going to do. But you don’t want to regurgitate this "transparency" because people will accuse you of being *too consensus*. So you must choose to be either slightly more hawkish or slightly more dovish. But as with recession forecasts, you don’t want to make strong near-term off forecasts because market pricing could influence policymakers - they try to avoid shocks. So maybe choose a 6-12 month window. If you still get your CB forecast wrong you have two potential excuses a) you can say officials are making a horrendous "policy mistake", or b) you can say their "reaction function has changed", which is a posh way of saying they are behaving erratically. Just because the central bank employs 10,000 people and has more resources than you can possibly imagine, doesn’t mean they have better information that a sell-side economist armed with Excel and a few Bloomberg headlines.

7) Market forecasts. This is really hard and it's best to avoid this altogether if you can. If you can’t, perhaps because you are an interest rate "strategist", your best option is to choose a forecast slightly higher of lower than the current spot price and then vary it in sync with the latest market trends. If the yields are falling, lower your 12-month forecast slightly. If you look on Bloomberg, you will see that this is exactly what the consensus does. The same approach works for oil prices.

8) Forecasting the stock market. Most of the time the equity market goes up so, to quote a former equity strategist colleague "you need a **** good reason" to forecast it not going up. But you should also think about the response you will get from clients, especially if you work at an investment bank. If you forecast a bear market and it goes up, everyone will think you’re moron. If it goes down, everyone will hate you. But if you forecast a bull market and prices rise, you will become a hero (and if it goes down, nobody will remember because everyone will have got it wrong).

9) Mastering Chartism: It is possible to show a relationship between almost any two variables in macroeconomics as long as you can display them on two axes and are willing to spend enough time manipulating the second axis, experimenting with data lags, inversions or various moving averages. If you still can’t make the relationship work, extend your history to cover the Global Financial Crisis; everything looks correlated during the GFC.

10) And if all else fails, blame "liquidity". Liquidity can explain *everything*, it’s basically a residual. And since nobody can measure it, you can just infer its presence (or not) from whatever is happening to market prices. It's the equivalent of "confidence effects" in macroeconomics. The political right particularly like the term "liquidity" because it is a convenient way to accuse policymakers of ‘distorting’ markets without any actual evidence.

-

1

1

-

-

Daily Dashboard

in General Trading Strategy Discussion

Posted

China locks down city to prevent virus spread. Indices, Oil and Gold down. Bonds up.

ECB rate decision at 12:45 and presser at 1:30.