Nvidia’s share price: Q1 earnings preview

Nvidia’s share price has plunged by close to 40% year-to-date. Can its upcoming Q1 results aid to reverse the bearish sentiments?

Source: Bloomberg

When does Nvidia report earnings?

NVIDIA is set to release its quarter one (Q1) financial results on 25 May 2022, after market closes. At the time of writing, expectations for its Q1 earnings per share (EPS) is coming in at $1.29, up 40.2% year-on-year (YoY). Revenue is also expected to increase to $8.1 billion, up 43.4% from a year ago.

Nvidia earnings – what to expect

For the upcoming earnings release, much will still depend on its two core business segments, gaming and data centres, to deliver. Recent outperformance for Advanced Micro Devices (AMD) results point to resilient demand in the data-centre space, which may bode well for Nvidia by highlighting ongoing tailwind from enterprises’ digital shift into artificial intelligence (AI) and high-performance computing. While revenue growth may be expected to moderate further on a YoY basis from the initial Covid-19 surge, an expected 43.4% increase still points to an above-trend growth rate over the past five years. Ahead, the huge untapped market for consumers’ upgrades to newer versions of its GTX-series graphics cards may continue to be a catalyst to underpin demand in the months ahead.

That said, a key risk to watch may be the plunging cryptocurrency prices from April into May, which may be a potential roadblock for its gaming segment. This is considering that mining demand tends to fade in line with falling cryptocurrency prices, which translates to lesser demand for Nvidia’s cryptocurrency mining processor (CMP) sales. Bitcoin and Ether are currently trading down around 36% and 45% year-to-date at the time of writing.

Nvidia’s earnings before interest, taxes, depreciation, and amortization (EBITDA) margin has remained resilient thus far, with its product technological advantage allowing rising costs to be passed on to consumers through higher average selling prices (ASPs). An area of uncertainty will be the potential easing of global chip shortages, which may make further rise in ASPs unsustainable. Recent statement from Nvidia in end-April shows that its graphics processing units (GPUs) are ‘restocked and reloaded’, which suggests that the peak of GPU shortages may be nearing or even past its peak. If this holds true, that may translate to some moderation in product pricing from its previous Covid-19-induced surge. This will place its margins on close watch over the coming months.

Source: Nvidia Corporation

Nvidia’s valuation

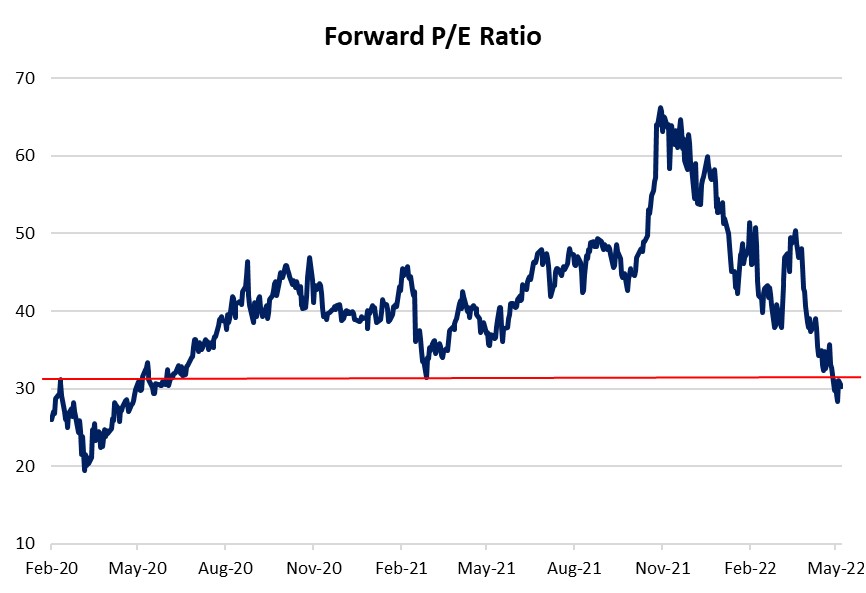

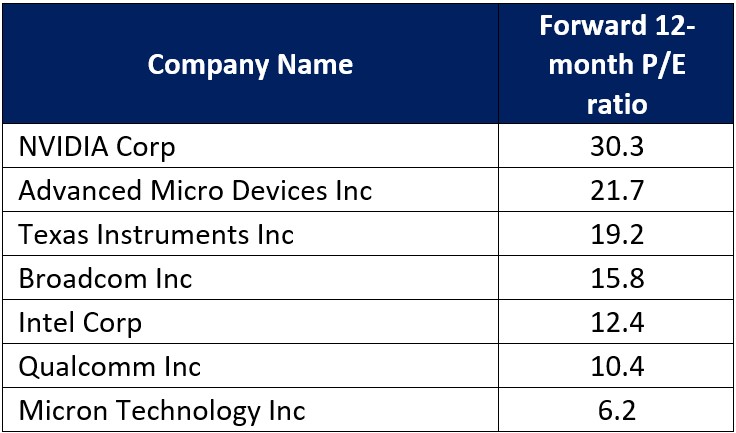

The ongoing interest rate upcycle has put equities’ valuation in focus, particularly for growth names like Nvidia whose lofty valuation is driving greater sensitivity to the US Treasury yield movement. Recent heavy sell-off has brought about a re-rating for Nvidia’s forward price-to-earnings (P/E) valuation back to its pre-Covid-19 levels of 30.3, its lowest since May 2020. While its valuation may tower above its industry peers, an attributing factor for the premium is due to its above-average growth. Its five-year historical earnings per share growth stands at 52.8%, way above the semiconductor industry average of 15.9%. High market expectations are still being priced with an absolute forward P/E above 30 and failure to deliver in the upcoming earnings release may run the risk of further re-rating in share price closer to industry mean.

Source: Nasdaq

Source: Nasdaq

Currently, the stock has 40 ‘buy’ recommendations, nine ‘holds’ and one ‘sell’. The Bloomberg 12-month consensus target price of $323.95 suggests a potential 87.6% upside from current price of $172.64.

Nvidia shares – technical analysis

On the four-hour chart, a bullish divergence on both the relative strength index (RSI) and moving average convergence divergence (MACD) indicators may increase the chances of a near-term relief rally, coming after the heavy sell-off of close to 45% since the start of April. This comes along with a bullish pin bar candlestick on the daily chart last week. That said, longer-term outlook will remain fragile with ongoing policy tightening set to cool economic growth momentum, which raise some doubts on whether any bounce can be sustaining. The longer-term downward trend for Nvidia’s share price remains intact, with the series of lower highs and lower lows imprinted since November last year. A look at the 100-day and 200-day simple moving averages (MA) also revealed a bearish crossover, marking its first time since 2019.

A near-term relief may potentially drive a retest of the $206.00 level, where a previous support level will now serve as resistance to overcome. Near-term support may be at the $156.30, where some dip-buying was seen towards the end of last week.

Source: IG charts

Source: IG charts

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now