ECB Meeting Preview: Will Lagarde take the foot off the gas on banking concerns?

The ECB plans for another 50-basis point rate hikes have come into question, with the committee to decide between combatting inflation or maintaining stability in the banking sector

Source: Bloomberg

Source: Bloomberg

ECB meeting: the basics

The forthcoming European Central Bank (ECB) meeting will take place on Thursday 16 March 2023. The initial monetary policy decision will be announced at 1.15pm BST, with the press conference getting underway at 1.45pm.

Coming at a time when markets are weighing up the risk of contagion after the fall of the Silicon Valley Bank, we have seen a greater degree of uncertainty added ahead of this meeting. Ordinarily huge market declines and sharp losses for bank stocks associated with higher interest rates is not an environment that screams a need to hike once again. However, with strong guidance in place over what the committee plans to do on Thursday, there is still an overwhelming expectation that the bank will stick to their guns.

What is the inflation outlook and how will it affect ECB thinking?

Inflation remains a thorn in the side of the ECB, with recent CPI readings giving them more reason to tighten further. Starting off with increases in French and Spanish inflation, we have seen the wider eurozone CPI figure slow its descent to post a disappointing 0.1% decline last month. That does raise concerns that the ECB face a tough task in driving down inflation as consistently as has been the case the three-months prior.

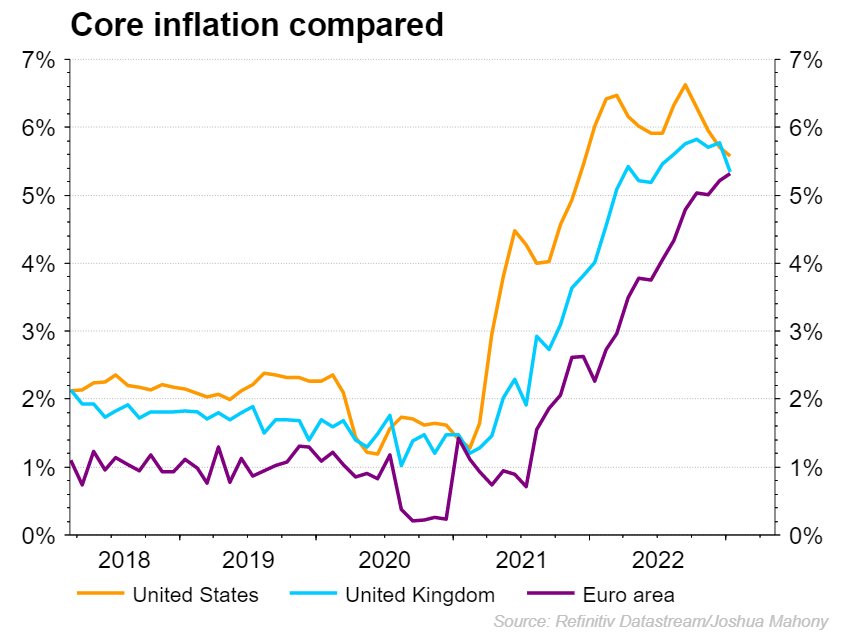

Unfortunately, the slowdown in headline inflation is not the only issue to contend with, as the core CPI figure remains a major sticking point for the ECB. As we can see below, the recent declines in UK and US core inflation has come in stark contrast to the constant rise seen in the Euro area. With this metric hitting a record high in February, the bank will need to see it turn a corner before they can start taking a less hawkish approach.

What do we expect from the ECB?

From an interest rate perspective, markets are pricing in a 69% chance of a 50-basis point hike. With markets fearful of the potential contagion throughout the banking sector, the likeliness of a smaller 25-basis point move has increased. However, we have even seen Deutsche Bank and Nomura raise the prospect of a pause on the rate hike path should market volatility continue into the Thursdays meeting.

Source: Eikon

Source: Eikon

Watch out for any shift on outlook for growth and inflation, with the ongoing upward trajectory in core CPI providing a particular risk that we may see that outlook for above target inflation pushed further into 2025.On the quantitative tightening front, it is unlikely that we see any major move here, with the bank currently aiming to end the asset purchase programme (APP) by year-end.

EURUSD on the rise as SVB crisis impacts Fed outlook

EUR/USD has been losing ground for much of the past month, with concerns growing that we could see a risk-off move for equities given economic risks and growing calls for further hikes at the Fed. While the SVB crisis brings heightened risk-off sentiment for equity markets, it has also dampened expectations for a major hike by the Fed this month. However, the ECB take the stand first, and their willingness to hike in the face of concerns around the banking sector will be very telling. A 50-basis point hike could bring another leg higher for EUR/USD, while a decision to ease back on the pace of tightening would likely drive the pair lower. The recent move through 1.0694 signals a heightened potential for upside here, with a decline through 1.0524 would signal a continuation of the bearish trend seen throughout February.

Source: ProRealTime

Source: ProRealTime

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now