Kodiak

-

Posts

573 -

Joined

-

Last visited

-

Days Won

31

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Kodiak

-

-

-

-

About DAX

This could go either way (as usual?)

We should get a sell off when the neckline breaks in the big head and shoulder formation

But will it be a false sell with a fast drop and a fast recovery (v-bottom) and then up to new all time highs

or is this the real thing with a long term top and a bearmarket?

Time will tell?

The target for the HS formation is 9 600 ish (2 000 neck to top)

-

14 hours ago, Caseynotes said:

Not giving away much in the email that only some seem to have received. Was just looking at the demo platform that still has the old formula and the difference is quite startling. (see pics below). It all seems a bit odd though or maybe just wishful thinking on the part of IG and they have had their card marked by the FCA, wait and see. Certainly if things stand as they are the whole KO thing would seem to have been a waste of IG's time and money, maybe they still have a trick up their sleeve, who knows.

I suppose FCA and ESMA thinks its better for us in the 80% "club" to lose 625 instead of 135?

-

2

2

-

-

I dont use metatrader much but i think its possible to run a EA on FTSE dfb and place the trades on something else?

and if we could do that (run ea on ftse dfb) and place the trades on FTSE KO then it open up new ways to trade KO?

-

2 hours ago, Ozee said:

The KO's are unsuitable for me as I prefer to put in an order, stop loss and limit and not have to closely monitor the market and wait for price and technicals to confirm entry - as is the case with KOs. I just do not have the time to sit by the screen and observe what price is doing every minute of the day...it does my head in!

Seems like eventually I'll no have choice but to deposit much more money to cover the margin requirements to spread bet as near normal to what I did before these ESMA regulations from the EU...(roll on Brexit!)

I suppose it has something to do with ESMA and that the KO is some kind of option and that makes things more complicated?

But as i said before if we could trade KO using prorealtime/proorder and maybe metatrader then we could use the program to open and close the trade if certain condition is met

i dont see why ESMA would have any problem with that?

so lets wait and see whats happens

-

1

1

-

-

1 hour ago, Caseynotes said:

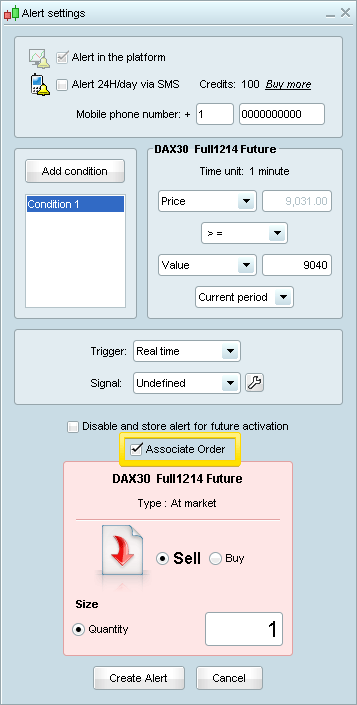

@PandaFace I would have said that until the inner stop loss arrives you'll want to put in a price level alert in at a nominated stop loss position then close manually once the alert has triggered ... but KO's don't seem to have an alert function.

Meanwhile if we could use prorealtime/proorder to trade KO it would open up new functions like "associate orders to alert" not on server but works if the program is running

(proorder is on server)

-

1

1

-

1

1

-

-

10 hours ago, PandaFace said:

Surprised this hasn’t got more tranction. This is literally the solution to the esma stuff and hardly anyone is on it...?

Odd.

Its only for SB so thats limits the interest?

and as said above adj stops would be great and if we could trade it in prorealtime/proorder it would be even better

-

24 minutes ago, Zant-A said:

I think IG reducing the amount per point would go some way to alleviating the pain of the massive increased margin. Example being FTSE index allowing for £0.25 per point rather than the current £1. What I end up doing is opening a position against the £1 minimum stake and then selling / buying £0.75 to get the position down to a manageable margin against other spread betting positions. No doubt getting rich quick has taken a back seat but also the getting poor even quicker may also not happen as often either albeit the high margins have had a massive impact on my use of Spread Betting and the criteria for 'Professional' traders is just not a practical approach to deciding who does know what they are doing including risks and who does not.

Yes, and when using proorder/prorealtime you can trade multiple systems at the same time long and short and this new esma thing have done this a lot harder

Min size cfd Hong kong needs almost 3 K margin and if you have one long and one short system running you need 6 K only for that

-

EU in a nutshell!

-

"The CySEC note to licensed CIF brokers indicates very clearly that the new rules will apply not just to clients which brokers take from within the EU, but also very much applies to clients from outside the EU who deposit and trade with the EU-licensed broker."

https://www.leaprate.com/forex/regulations/cysec-esma-cfd-leverage-restrictions-non-eu-clients/

Switzerland on the other hand seems to ignore EU/ESMA?

-

Any progress with the historical sentiment data?

Thinking of something like an indicator in prorealtime from -100 to 100?

i see others like ETX and FXCM have some new features with sentiment data,

Alert trigger trading -

in General Trading Strategy Discussion

Posted

Or use an indicator like this

But i think its only working when prorealtime is running ?

try it on demo first