ECB meeting preview: 75bp hike widely slated, but energy and FX factors mean inflation will remain elevated

The ECB are widely expected to implement a 75bp rate hike, but an ongoing energy crisis and euro devaluation mean that inflation will likely continue to rise.

Source: Bloomberg

Source: Bloomberg

ECB meeting: the basics

The forthcoming European Central Bank (ECB) meeting will take place on Thursday 8 September 2022. The initial monetary policy decision will be announced at 1.15pm BST, with the press conference getting underway at 1.45pm.

What are the current issues faced by the ECB?

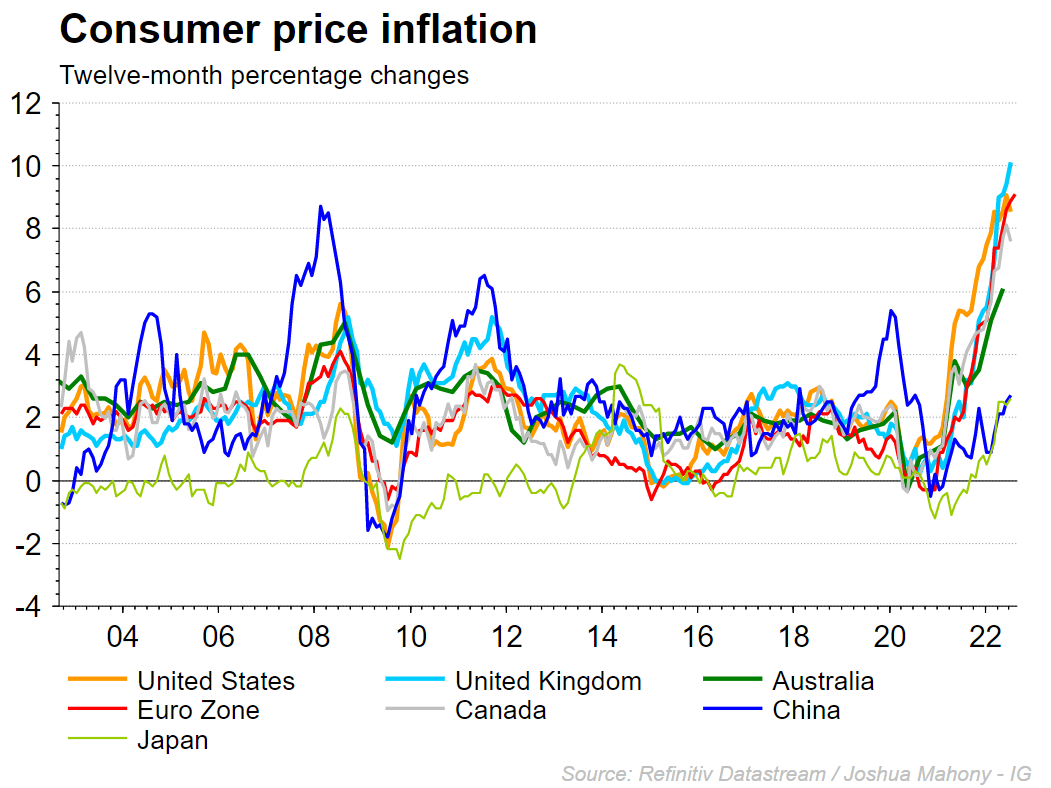

Inflation remains the dominant issue facing central banks throughout the Western-world, with the August reading of 9.1% representing a fresh record high for inflation in the euro area. The chart below highlights this recent plight, with prices rising sharply throughout Europe and North America in particular. With much of the upside seen across energy markets originating from the restriction of energy trade between Russia and the West, it is evident that those further afield have disproportionately lower inflation to deal with.

Over the years, central banks have often turned to the likes of the core consumer price index (CPI) or core Personal Consumption Expenditure (PCE) US related, readings to provide a gauge of prices without the influence of volatile factors such as energy. For the most part, monetary policy will do little to curtail such price rises in any case.

However, the chart below highlights that core inflation also lies well above target, with the ECB evidently realizing that they need to take decisive action if they are to limit this rise. The news that Russia plans to stop gas exports to Europe highlights the fact that prices can easily continue their upward trajectory irrespective of monetary policy.

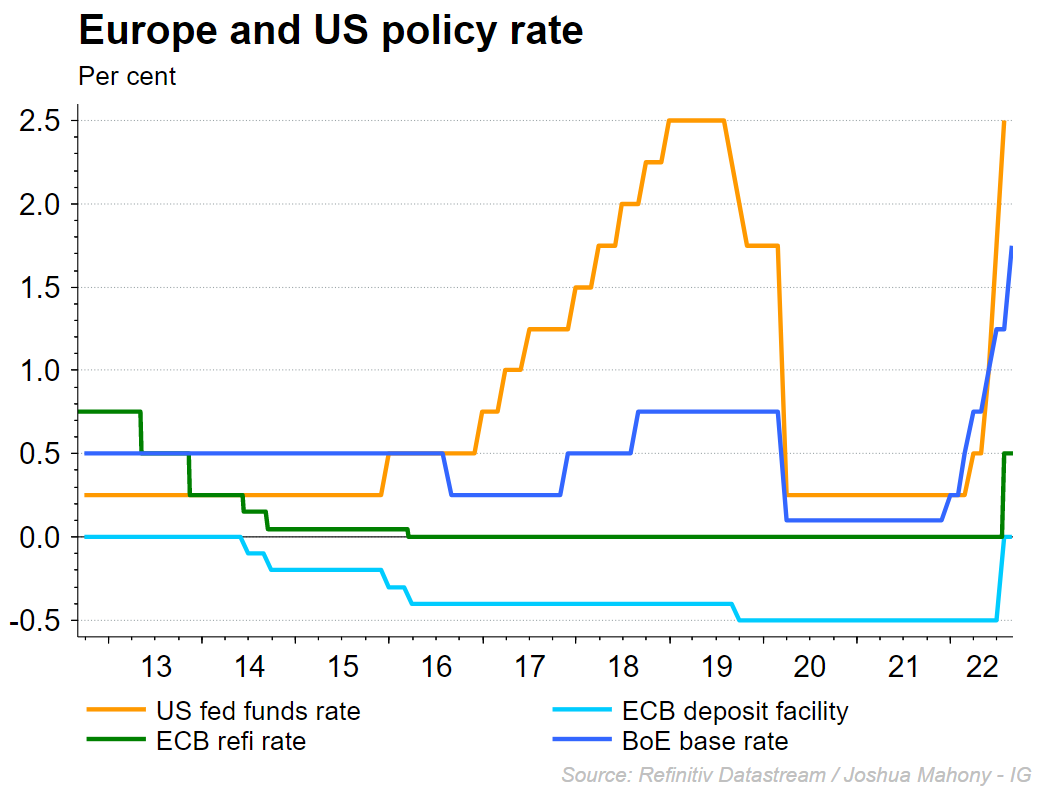

While the ECB took their time tightening in the face of rising inflation, they appear to be fully on board if the recent commentary is anything to go by. As the Federal Reserve (Fed) looks likely to implement a third consecutive 75-basis point (bp) hike this month, the likes of Goldman, Bank of America, BNP Paribas and JPMorgan all expect a similar sized move from the ECB. That follows on from recent commentary out of the ECB, with Holzmann and Muller both stating that such a move is certainly being considered.

However, quite whether the eurozone is as well equipped to deal with as steep a tightening in credit conditions remains to be seen, with chief ECB economist Philip Lane warning that a slower approach may be necessary to allow households and businesses to adjust accordingly. Unfortunately for Lane, markets have paid little attention to his more balanced view, with many believing a 75bp hike in the refinancing rate has been fully priced in. This provides a significant risk that they hike by just 50bp, sending the euro sharply lower.

The risk for the eurozone here is that by setting up a 75bp hike, they create a rod for their own back, with markets expecting similar sized moves as inflation continues to rise. The Russian decision to shut off all gas exports to Europe provides expectations that energy will continue to drive headline inflation higher, while a declining euro also bring imported inflation. With that upward trajectory for inflation in place, this sharp rise in borrowing costs could come at the expense of fiscal stability in less stable member states such as Italy. It is that uneven nature of the eurozone which makes Christine Lagarde’s job much more difficult than that undertaken by the Fed.

Part of the predicament for the ECB comes via the sharp devaluation of the euro over the course of this crisis. Unlike the Fed which enjoys haven demand for the US dollar alongside any monetary based appreciation, there is a good chance that the ECB still sees a weaker euro and imported inflation irrespective of Thursday’s decision. Thus, any efforts to tighten at the ECB needs to be convincing enough help stabilise the declines in the euro if it is to have a meaningful impact on inflation. Unfortunately, the relatively impact of Russian actions on Europe, coupled with haven demand as markets slide will make it difficult to derail the EUR/USD downtrend.

Will the ECB continue to raise rates throughout a recession?

Jerome Powell’s appearance at Jackson Hole provided a clear signal to markets that the Fed will focus solely on bringing down inflation as a priority despite the economic risks involved in doing so. The ECB are expected to follow suit, with the credibility behind that message key to shifting expectations and impacting prices. However, with energy prices continuing to rise, we could find ourselves in a position down the line where the ECB is faced with a sharp recession and stubbornly high inflation.

Quite how long it will take for the ECB to reverse course and loosen monetary policy once again remains to be seen. However, with inflation and growth levels expected to be at more extreme levels in the eurozone compared with the US, there is a significant risk that the EUR/USD falls further if they seek to reverse course too early.

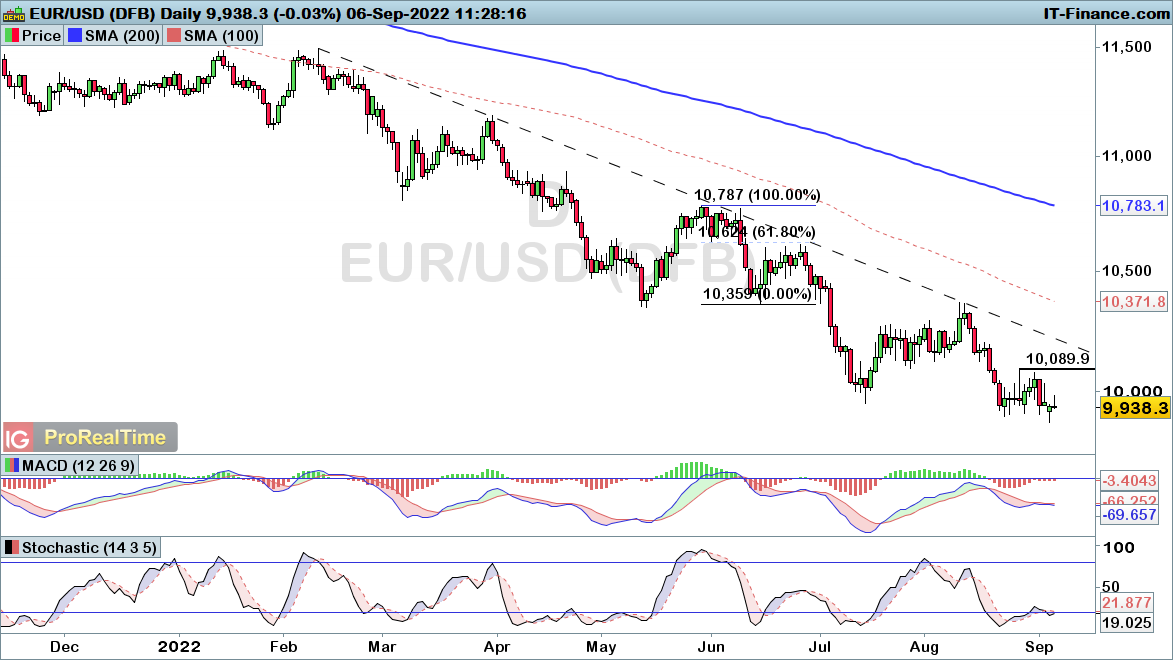

EUR/USD continues to move lower after the parity break

EUR/USD has continued its downward trajectory following the recent break through $1.00 support. With markets expected to favour the dollar given its haven role and lessened economic risks, it makes sense to expect further weakness as we move through this crisis.

The daily chart does highlight a wider descending trendline which will likely be revisited at some point. However, we are yet to see an intraday signal to tell us that such a move is forthcoming. With that in mind, bearish positions are favoured, where a rise through $1.009 would be required to signal a wider retracement into trendline resistance.

Source: ProRealTime

Source: ProRealTime

DAX attempting to regain ground from the key support zone

The DAX has been hit hard in the lead up to this ECB meeting, but things are starting to turn. The decline into the key 12385-12432 support zone brings the potential for another rebound. However, we are yet to see such a push out of the intraday downtrend, with a rise above 13057 required to bring a bullish phase into play.

Source: ProRealTime

Source: ProRealTime

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now