-

Posts

522 -

Joined

-

Last visited

-

Days Won

9

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by trade247

-

-

43 minutes ago, TrendFollower said:

The smart money would have shorted this since August 2018.

what specifically happened in August 2018 to make it a "smart" move to short then?

Just going through that article @wjw22 and this bit stood out "The project has been running since 2010 but remains in its development phase and is yet to generate a single pound of revenue"

That's absolutely mental. You always hear about a lack of profitability, but a 9 year old company which hasn't even seen a lick of REVENUE. That seems crazy to me. However with that said they're looking at a lifetime mining value of 100 years. Could be a good keeper if things pan out the right way.

This also certainly isn't for the faint of hearted "Since 2009, the share price has fallen more than 50% from its previous peak five times. This illustrates the speculative nature of the stock, which is a widely held by individual investors in the hope that its lottery ticket style attributes could see them win big."

-

11 hours ago, Caseynotes said:

there is differing criteria for IG listings for leveraged and non-leveraged stocks, see link below posted just a couple of days ago on AIM stocks, and don't forget the IG DMA platform for leveraged or non-leveraged share dealing direct on the LSE.

https://www.ig.com/uk/news-and-trade-ideas/shares-news/top-100-aim-shares-190408

Interesting. So the Penny stocks / AIM markets which they say to have a look at are

- Burford Capital: world's largest provider of arbitration and litigation finance

- Fevertree Drinks: the upmarket mixer maker

- Hutchinson China MediTech: the biopharma and pharma stock

- ASOS: fast fashion for millennials

- Abcam: a profitable biopharma business

Interestingly ASOS are down over 50% over the last 12 months and they've made the list. I know there are also one of AIMs largest success stories up quadruple digit % since their initial float. Remember when they were called As Seen On Screen? And they used to highlight things which people on Big Brother used to wear etc.... ahhh the good old days.

-

1

1

-

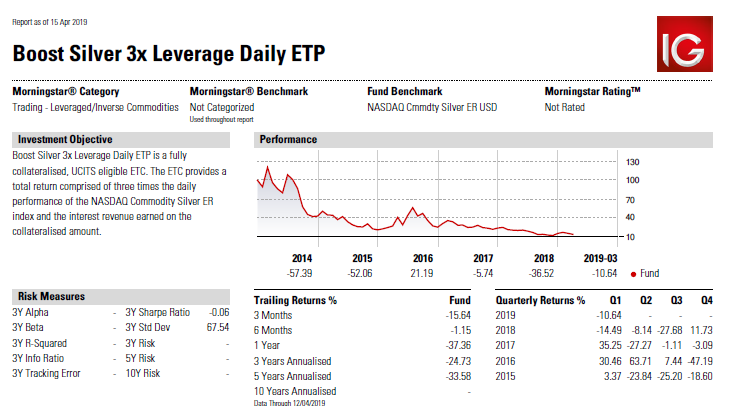

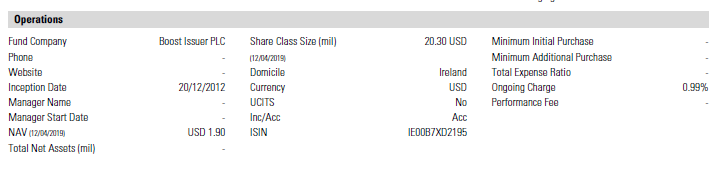

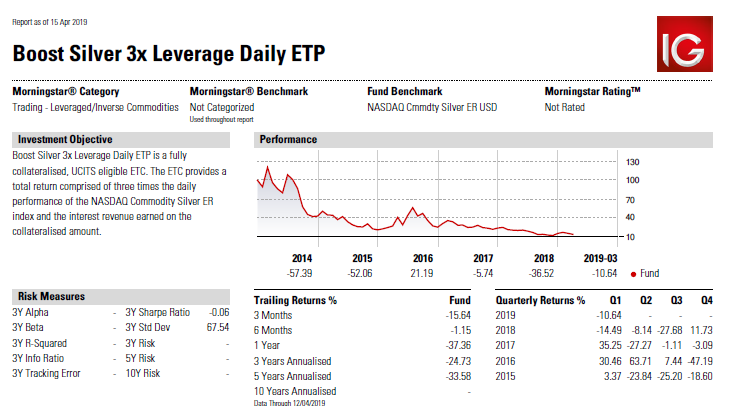

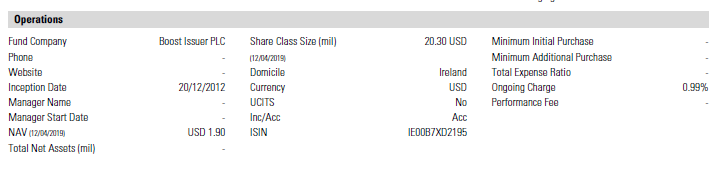

This should be the important parts of the sheet.

-

1

1

-

-

there are some interesting small market cap stocks out there though which trade for pennies and have more than 10 mil mcap. I guess reason for this is holding a significant percentage of the company in a spread betting account and liquidity and everything. Imagine at 5% margin deposit you'd only need £150,000 to own 5% of the company at £3m which wouldn't take long to accumulate on the platform.

-

1 minute ago, Caseynotes said:

the only thing to do is split screen and one on each.

oooo nice work around. Didn't think of that 'hack'.

-

As in two bols? One say a SD of 2 away and the other of say 3? Don't think you can. Maybe PRT or MT4? @Caseynotes is good with those platforms.

-

Depends on how 'penny' stock you mean. You can spread bet and CFD trade on small market cap stocks, which in theory have stock in the value of pennies. You need to be mindful of the market cap though. That's the main thing.

IG requires Mcap of I think about £10million.

-

thanks for the Real Vision video.

its almost annoying these sort of clips - you can't have it on in the back ground whilst you're working or doing other stuff. You really need to concentrate to get the value out of it.

Will have to set some time aside!

-

True. Its a tough one. In my mind there have actually been a few 'triggers' which haven't come through in the market. Lots of opportunity to kick off the short but the market bulldozers on.

We're at a pretty low vol period at the moment. That's probably an indicator on the contrarian viewpoint that things are about to get interesting.

What event that will be (up / down / vol around a consolidation) who knows.

-

Seeing as options have been mentioned a few times, I thought it would be worth pointing out that you can trade Stock Options with IG, but you do need to call them though. It's not ideal, but you can see the open position on your computer. You have to call to close as well.

Other options like FX etc can be done on the platform. Would hope to see stock options on the platform at some point. Would be interesting.

-

1

1

-

-

theres the pull back on the 1 hour (to marry the chart above on the right).

-

whilst interesting, should you not measure top to bottom, rather than waiting for an all time high to confirm another bull market. For example, can you not say that we've been in bull market since 2009? We can't say we're not in a bull market from 2009 to 2014 surely?

it's a tough one. I think we're running on fumes personally. when it breaks liquidity will be thin and it'll plummet like a rock. theres so much central government manipulation this time around as well. If that goes then likely we'll see a hyper cycle pull back.

-

-

great read thanks @Mercury

-

Also I think there is a lot to say for the 'contrarian' trade to what the mass media news is saying. When all the news articles are saying 'BUY' or 'we're at the top' its probably worth looking at reducing your longs and selling.

When it comes to oil I have had the following emails today alone...

From IG - "Oil is leading commodity price gains finding a catalyst for the move from in fighting in Libya, which threatens to disrupt global oil supply."

From Reuters - "Oil prices rose to their highest level since November 2018, driven upwards by OPEC's ongoing supply cuts, U.S. sanctions against Iran and Venezuela, and strong U.S. jobs data."

From Bloomberg - "Crude is close to the highest level in five months this morning, with a barrel of West Texas Intermediate for May delivery trading at $63.45 by 5:40 a.m. Eastern Time as the escalation of fighting in Libya increases supply concerns. In other oil-market news today, there is huge interest in Saudi Aramco’s bond sale. Aramco Chairman and Saudi Energy Minister Khalid Al-Falih told Bloomberg TV this morning that $30 billion of orders have been received. The company is expected to offer at least $10 billion, with pricing as soon as tomorrow"

Blonde Money - "Thrives as oil producers sell futures to protect themselves from price falls and many like to speculate on the market. There is over and under supply and the level of stocks links the spot (immediate) oil price to the futures price. Backwardation is where futures prices are below spot and contango where they are above. Today, see chart below, OPEC cut production, demand is picking up and because of backwardation, suppliers run down inventory. Speculators need a high risk premium as ample stocks dampen price volatility and the reverse is true, low stocks amplify volatility. The curve says high prices will not last yet Saudi Arabia, OPEC’s largest producer, needs $80 per barrel to balance its budget, a dilemma"

-

1

1

-

-

have you had that email confirming that your account is open?

is the account funded?

those are the questions that come to mind but call them otherwise.

-

also inflation in America is very much under control, in fact too much. The Fed tries to keep the personal consumption expenditure (PCE) index at 2%. The Fed raised rates 9 times since December 2015 in anticipation of inflation rising. Falling core inflation may be seen as a sign of a weaker economy, but components can cyclically follow the business cycle (restaurant meals) or not (health care). The chart below shows not much has changed in either. Where is the cyclical inflation given America’s strong labour market?

-

1

1

-

-

For those who think Brexit is having an impact on the FTSE and FTSE Mid (more for the facts GBP devaluations can make an easy trade available on the arguably global FTSE index)

Short on time? Here's your quick Brexit summary:

Theresa May has suffered a substantial parliamentary defeat on a third attempt to pass her Brexit deal through parliament.

The prime minister had sought approval for her deal on the UK’s withdrawal from the EU on what had long been scheduled to be Brexit day.

MPs voted by 286 to 344 against the EU divorce treaty, which if passed would have opened the way to Britain leaving the EU on a revised date of May 22.

Speaking after the result, Mrs May said: “The implications of the House’s decision are grave.”

“The legal default now is that the United Kingdom is due to leave the European Union on 12 April. In just 14 days’ time.”

Amid speculation she could be forced to call a general election, she added: “I fear we are reaching the limits of this process in this House.”

In immediate response to the deal’s defeat, Donald Tusk, the president of the European Council of EU member states, called an emergency EU debate.

“In view of the rejection of the Withdrawal Agreement by the House of Commons, I have decided to call a European Council on 10 April. #Brexit,” he said on Twitter.

Britain is now due to leave the EU on April 12 without a deal unless Mrs May can persuade the 27 other EU leaders to grant a further extension in the Article 50 exit process. This would, however, require the UK to take part in European Parliament elections in May.

Got this from the FT's brexit roundup emails which I would recommend to all. Very good.

-

as casey said, however there are a number of 'short ETFs' out there which may be of interest and give you a shorting opportunity. (not really shorting, but gaining value when the underlying assets drops).

-

3 minutes ago, Caseynotes said:

@cryptotrader Increasing volume going through in the futures market.

fair - great spot.

i'll stay in then

-

-

-

-

interested to see the P500 reply. I hope he publishes all official replies although I doubt he will. It was either an error which they'll look to rectify, or he was already on margin call and this just happened to coincide. Will try and keep an eye out but let us know whats occurring if you spot something?

he's just updated

US OIL

in General Trading Strategy Discussion

Posted

Oil hits 2019 high above $72 on China growth, lower U.S. inventories