-

Posts

13,207 -

Joined

-

Last visited

-

Days Won

556

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Caseynotes

-

-

-

2 minutes ago, Provaton said:

From the Lancet paper you referenced a few posts back:

https://www.thelancet.com/journals/laninf/article/PIIS1473-3099(21)00648-4/fulltext

The evidence is in front our your face, in the paper you referenced @Caseynotes but you chose to ignore it.

no, was looking at transmission as was the main point of the study.

-

1

1

-

-

3 minutes ago, Frankieburgo said:

Just relax buddy. Take a deep breath.

FO with your patronising BS.

-

1

1

-

-

1 minute ago, Frankieburgo said:

And yet you still agree that vaccines are more effective than ivermectin. Which is it?

The fact is, vaccines remain the most effective tool we have to manage COVID.

You've already proved we can't trust anything you post because you DON'T DO YOUR OWN RESEARCH

err no, I said no such thing, I'm not sure you understand English?

The vaccines are showing extremely poor if not zero efficacy which is the only explanation as to why covid transmission is increasing exponentially in high vaxxed countries. The evidence is in front of your face.

-

1

1

-

-

1 minute ago, Frankieburgo said:

Like most heavily vaccinated countries that have reduced social distancing restrictions, cases have indeed spiked.

But due to their high vaccination rates, Singapore has one of the lowest death rates. Proof that vaccines WORK in helping things return to normal.

haha, straight into the bull***** home made supposition, what a joke.

Sorry to disappoint but have posted many studies that charted the decline in vaccine efficacy down to zero.

-

1

1

-

-

-

Lancet Study Finds COVID Shots Do Not Prevent Transmission.

Lancet Study Finds COVID Shots Do Not Prevent Transmission - Liberty Counsel (lc.org)

-

1

1

-

-

your 'report' is dated 5 Oct. The article is dated 21 Oct - see the problem?

-

1

1

-

-

2 minutes ago, Frankieburgo said:

Sorry, cannot trust you given that you post things mindlessly without doing your research first.

Having "family" living in Melbourne without solid evidence of outages is purely anecdotal. For example me saying I lived in Melbourne for three years and have lots of friends still living there who've said they've never experienced outages.

Don't expect you to believe anything, in fact I don't care what you believe. The report in a national news organisation coincides with many similar audits on death certs I've seen and posted here in the past, as I said before. Evidence just keeps mounting up.

-

1

1

-

-

6 minutes ago, Frankieburgo said:

I can't find any source in the article you linked for where deaths have been adjusted.. Official stats still show 130k

Try asking the Italian National Heath Institute if you don't like it.

-

1

1

-

-

3 minutes ago, Frankieburgo said:

Also false. No evidence of that. In fact there were a bunch of livestreams direct from the protests .

And you've just proved your complete lack of research for the stuff you post.

DO YOUR RESEARCH

no evidence of what? I have plenty of family living in Melbourne and outages are true so don't bother trying to tell me what does or doesn't happen there.

-

1

1

-

-

Just now, Frankieburgo said:

It's your link, not mine. You've just argued against yourself. Truly selfaware now Casey. Top lad .

I take it English isn't your first language either.

-

1

1

-

-

''The National Health Institute in Italy has recalculated the Covid death toll since February 2020.

It was 130,468. Now it thinks 3,783 were directly due to COVID-19 ~3% of the total.''

-

1

1

-

-

4 minutes ago, Frankieburgo said:

What, $1m to an independent fact checking organisation that is transparent enough to ACTUALLY show where they get their money from. ooooohhh , what a juicy conspiracy 🙄

Edit 1m instead of 100k

wtf are you saying? 1 mil is more than enough.

6 minutes ago, Frankieburgo said:Read your own links!

"While many treatments have some level of efficacy, they do not replace vaccines and other measures to avoid infection. Only 25% of ivermectin studies show zero events in the treatment arm."

Why should they say 'replace' the vax? Doesn't change Ivermectin's proven efficacy.

-

1

1

-

-

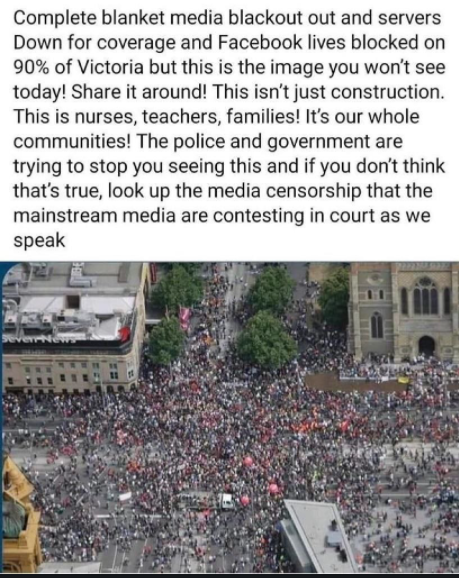

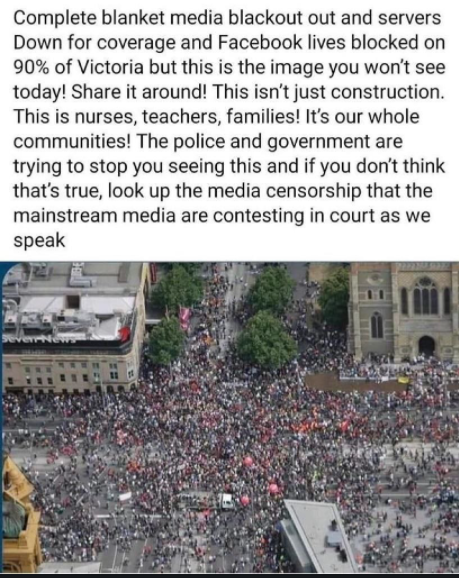

11 minutes ago, Frankieburgo said:

LOL DEBUNKED:

You might be right that the image is false but not the text. Vic has shutdown internet traffic in the past to censor news.

-

1

1

-

-

2 minutes ago, Frankieburgo said:

Of course he invests in drug companies, exactly what I've been saying. I don't see how that's any different to people choosing green investments because it's what they believe in the right thing.

It doesn't make it some dark conspiracy..

hahaha, are you for real?? he funds factcheckers to falsely discredit scientific studies that might impinge on his profits ffs. naive.

-

3 minutes ago, Frankieburgo said:

Again you post these pics of screenshots taken from dodgy Facebook posts, with NO links to either the data or sources. A quick Google search completely debunks these charts if you bothered to look.

There is ZERO evidence to suggest ivermectin has reduced excess mortality in Mexico.

ACTUALLY ...

The website is there, you can go through and check all the trials if you like.

Top tip; Stop watching MSM and do your own research.

-

1 minute ago, Frankieburgo said:

Er bill gates SPENDS millions on vaccine research . He spent $4billion on vaccine development. Ain't making money from it.

Jeezus - he is a major stock holder in a number of the drug companies producing the vaccines, not to mention testing labs, PPE providers, the list goes on and on.

You really need to learn how to do research, start with how much his fortune has increased since the start of 2020, I think you might be in for a shock.

-

Melbourne anti vax passports protest;

-

1

1

-

-

11 minutes ago, Frankieburgo said:

Actually I linked factcheck.org which is well known to be extremely transparent with funding, just check their website.

Also you push a lot of stuff about ivermectin which happens to also be a drug, I'm sure your sources aren't funded by the companies pushing that .. right

Oh dear, main financial contributor to Factcheck.org is The Annenburg Institute that receives money from the Gates Foundation. Bill Gates of course is making a new fortune out of the vaccines hahaha ffs.

Fiscal Year 2022, First Quarter · Annenberg Foundation: $140,957 · Facebook (Third-Party Fact-Checking Program): $56,870 · Robert Wood Johnson Foundation: $52,100.2 Jun 2021 — The Annenberg Institute received a $999260 grant from the Bill and Melinda Gates Foundation last month. -

Just now, Frankieburgo said:

Actually I linked factcheck.org which is well known to be extremely transparent with funding, just check their website.

Also you push a lot of stuff about ivermectin which happens to also be a drug, I'm sure your sources aren't funded by the companies pushing that .. right

haha yes, you checked the web site - try tracking the money.

Ivermectin, what companies are pushing that? None, there's no money in it, the patents run out decades ago. It costs pennies. The govts have been funding it eg India and Mexico and in Africa.

-

What the modelers said would happen with the Sweden strategy last Summer. And what ACTUALLY happened (when you stick to being scientific).

Swedish Study: Pfizer/Moderna vax went from 92% to 47% ( against infection) at 4 months then to worthless after 7 months, AZ / JnJ went to 0% before 4 months. And overall effectiveness against severe covid in men went from 89% to 42% at just 4 months!

-

1

1

-

-

9 minutes ago, Frankieburgo said:

You are so contradictory it's hilarious. Selfawarewolve you are.

So you're claiming in your posts that the science is false, and now you're claiming that it's being suppressed.

I'm not claiming anything, I'm posting an editorial from the BMJ. If you don't like it take it up with them.

-

1

1

-

-

Covid-19: Researcher blows the whistle on data integrity issues in Pfizer’s vaccine trial.

Revelations of poor practices at research company helping carry out Pfizer’s pivotal COVID19 vaccine trial raise questions of data integrity & regulatory oversight.

Covid-19: Researcher blows the whistle on data integrity issues in Pfizer’s vaccine trial | The BMJ

The Virus and the Economy

in General Trading Strategy Discussion

Posted

err, I posted dozens of papers saying the opposite with regards serious illness. As I said, I've been posting studies on the decline for the last 6 months.

In fact it's become a joke.