-

Posts

1,728 -

Joined

-

Last visited

-

Days Won

23

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Everything posted by ArvinIG

-

App push notifications not working

ArvinIG replied to DoubleThinker's question in IG Technical Support - Platform and App Help

Hi @DoubleThinker, We are sorry to hear that you are facing a technical difficulty. I will forward your message to the relevant department to be fixed. All the best - Arvin -

Analysts believe that the aircraft engine maker’s shares, up 8% this year, have more room to grow. Source: Bloomberg Indices Shares Roll-Royce Price JPMorgan Chase Stock Rolls-Royce (LON: RR) shares climbed as much as 1.4% on Tuesday (17 August 2021) JPMorgan analysts lifted their price target on RR to 130pence earlier in the day They also raised their earnings forecasts for the next three years Interested in trading Rolls-Royce shares? Open an account with us to get started. JPMorgan raises Rolls-Royce stock price target Rolls-Royce’s share price performance is expected to improve in the coming months on the back of higher earnings, according to JPMorgan analysts. The analysts lifted their price target on the aviation engineer’s stocks to 130pence a share from 105p, while raising their earnings forecasts over the next three years jump by 49%, 31% and 25% respectively. The higher forecasts also take into consideration potential structural challenges, including the recovery of long-haul flights, JPMorgan added in a note on Tuesday. The firm also predicted that a reported sale of the group’s Spanish unit ITP Aero to consortium-led investment house Bain Capital for a rumoured €1.6bn (£1.5bn) could boost free cash flow to around £750 million by 2023. Finally, the analysts noted that Rolls-Royce’s first half underlying profits for 2021 beat consensus estimates by £536m, which indicated that its cost-cutting programme is starting to pay off. Rolls-Royce shares rallied as much as 1.4% following JPMorgan’s price target upgrade. Across the board, Rolls-Royce currently has a consensus rating of ‘hold’ and price target of 198p, based on the latest analyst data published by MarketBeat. The price target equates to a potential 78% price upside from the stock’s latest price of 111.28p. What’s your view on Rolls-Royce? Take a position on the stock today Trade over 16,000 international shares from zero commission with us, the UK’s No.1 trading provider.* Learn more about trading shares with us, or open an account to get started today. *Based on revenue excluding FX (published financial statements, June 2020) Rolls-Royce profitable in H1 2021, but 2022 in doubt Last week, the FTSE 100 company returned to the black, after reporting an underlying operating profit stood of £307 million for H1 2021, a reverse from H1 2020’s £1.63 billion loss. Underlying revenue, meanwhile, dipped 3.4% to £5.23 billion, from £5.41 billion in the year-ago period. Rolls-Royce’s resilient defence unit, which makes engines for military jets and powers nuclear submarines, buttressed the group’s 1H 2021 performance. The aircraft engine maker also said in the same release that it was on track to meeting its forecasts for 2021, with cost reductions and asset sales helping to tide it through a gradual recovery in long-haul travel. However, Rolls-Royce flagged that its 2022 goals could be delayed, as flying hours did not rebound quickly enough. The group had earlier expected to reach free cash flow of £750 million as early as next year. ‘The exact rate and timing of return is out of our control,’ said Rolls-Royce CEO Warren East. Nevertheless, the company maintained its guidance for free cash outflow to improve to £2 billion this year, and for cash flow to turn positive in 2H 2021. Kelvin Ong | Financial writer, Singapore 18 August 2021

-

Question on Daily Trading Report/Statement received by email

ArvinIG replied to RFSmithers's question in IG Account Support - MyIG Help

Hi @RFSmithers, You can change you dealing alerts on My IG > Settings > Price & dealing alerts: I believe that you will only receive the daily statement if you traded on that day. We are required to send you a statement for the day for compliance purposes. I hope that it helps. All the best - Arvin- 1 reply

-

- 1

-

-

HI @dex47, You will need to hold the shares on ex-date to be eligible for the dividends. If you sold you shares before ex-date you won't be eligible for the dividends. More details here. "Companies can pay several dividends a year. Prior to each dividend payment date, the company will set a record date — the date on which a shareholder must be recorded as such and therefore be eligible to receive the dividend payment. Once the record date has been set, than the ex-dividend date is set. It is typically a couple of days before the record date, but the exact timing depends on the rules of the stock market on which the company’s stock is listed. It becomes a marker date for investors. When buying stock, it normally takes about three days for the purchase to be settled and recorded and therefore investors know they must buy stock before the ex-dividend date if they are to get the next dividend payment by that company". I hope that it helps. All the best - Arvin

-

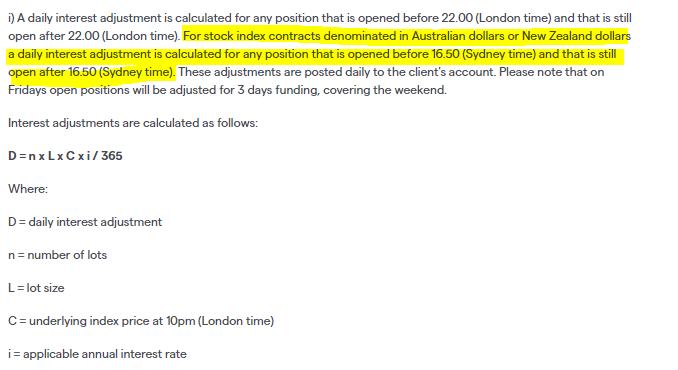

Hi @elbak283, https://www.ig.com/au/help-and-support/cfds/fees-and-charges/what-are-igs-indices-cfd-product-details In the Notes paragraph 7 : For stock index the cut-off time is 4.50 PM AEST. That would explain why you have been charged that amount. I hope that it helps ! If you have furhter questions please reach out to helpdesk.au@ig.com. All the best - Arvin

-

2021 aunal report release date

ArvinIG replied to MikeK's question in IG Account Support - MyIG Help

Hi @MikeK, Are you referring to the EOFY statements? They have been released 3 weeks ago. You should be able to find it on My IG > Live Account > Statements. A statement will be issued if you received dividend during that financial year. If you need further assistance please reach out to helpdesk.au@ig.com All the best - Arvin -

Charts randomly defaulting to White and Freezing.

ArvinIG replied to nit2wynit's question in IG Technical Support - Platform and App Help

Hi @nit2wynit, You can try to clear the cache and cookies on Chrome. If the issue persist please email helpdesk.uk@ig.com with a screenshot. The IT team will investigate the matter for you . All the best - Arvin -

Hi Suhail, Some stocks won't be available on your ISA account, you will see the error message :"instrument not tax wrapper enabled" If that's the case you will only be able to trade the stock on a share dealing account. All the best - Arvin

-

HI @seyd, I have already replied to your previous post. Unfortunately, you can't change the margin requirement they are fixed percentages. Please read through https://www.ig.com/en/cfd-trading/charges-and-margins. If you have any further question please reach out to helpdesk.en@ig.com All the best - Arvin

- 1 reply

-

- 1

-

-

Hi @rammy1964, IG operates under a custodian model,shares purchased are held by Citi in a direct custody capacity. The clients are the ultimate beneficial owners. You will receive dividends and be eligible to participate in any corporate actions such as rights issue. If you need further information please reach out to helpdesk.uk@ig.com All the best - Arvin

-

Hi @cperrie1, Our helpdesk email address is helpdesk.uk@ig.com. Please send your request to this email address with your account details. All the best - Arvin

-

-

instrument not tax wrapper enabled

ArvinIG replied to sbre3903's question in IG Trading Support - Dealing Questions

Hi @sbre3903 @mcowen, The "instrument not tax wrapper enabled" means that you can't trade this stock on a ISA account. You might be able to trade on a Share Trading account. If you need more information please reach out to helpdesk.uk@ig.com. All the best - Arvin -

Hi @seyd, Unfortunately, you can't change the leverage on your transactions. You can find the margin requirements on the "info" tab on the deal tickets : All the best - Arvin

-

Hi @ReenaVerma, 1. The minimum deposit of GBP 250 is normal, it is stated on the deposit funds page next to the field where you enter the amount : 2 . The page that comes up to verify/confirm your transaction is not managed by IG. It is your bank pop-in a verification window. It is possible that you made a typo on the amount the first time. There are 2 declined transaction on your account on for 250 one for 2500. I would recommend to call us on 0800 195 3100 while you are trying to make a deposit for live assistance. Card payments are immediate, if there is no amount on your balance it would mean that they were declined. Your bank might take a day or two to change the pending status on their end. I hope that it helps. All the best - Arvin

-

Hi @TCTIII Tom, We do offer TGS.OL on our platform. The stock is only available on Leveraged account ( CFD - Spread Betting). We created a specific thread for stock request here. For Share trading accounts, stocks from these countries can be added I hope that it helps - Arvin

-

Hi @CassiusWest, Once your documents are uploaded and verified the account opening team will finalise your application. For updates on your application please reach out to newaccounts.uk@ig.com. All the best - Arvin

-

Hi, On the App once you are on the chart if you tap in the middle once a menu should appear with the option to change the interval, indicators etc. All the best - Arvin

-

Year financial statement for ATO

ArvinIG replied to andrewthompson's question in IG Account Support - MyIG Help

Hi @MFRAGLER711, I have sent you out a statement for your Share Dealing account. I hope that it helps. - Arvin -

inquiry : does IG platform could be downloaded on mobile ?

ArvinIG replied to Ahmad1258's topic in Foreign Exchange (FX)

Hi @dcy, I will forward your concern to the relevant department to add the iOS app for clients in Taiwan. All the best - Arvin -

Hi @Ranks007, You can find how the borrowing cost on this page here. LIBOR is calculated according to the currency of the underlying instrument. If you’re long, you pay LIBOR (or the equivalent interbank rate). If you’re short, you receive it. Formula: Number of contracts x value per contract x price x (2.5%* +/- LIBOR%*) ÷ 360 Example: 1) You’re long 1500 contracts on Commonwealth Bank of Australia The contract value is AUD 1 The closing price is 83.90 The 1-month AUD LIBOR rate is 1.89% Cost = 1500 x 1 x 83.90 x (2.5% + 1.89%) ÷ 360 = A$125,850 x 4.39% ÷ 360 = A$15.35 overnight charge 2) Imagine you’re short 2 contracts on the US Tech 100. The contract value is $20. The 10:00 PM (UK time) price is 13200.00. The 1-month US LIBOR rate* is 0.11%. Our admin fee is 2.5% annually. Cost = 2 x $20 x 13200 x (2.5% - 0.11%) ÷ 360 = $528,000 x 2.39% ÷ 360 = $35.05 overnight charge. *We use US LIBOR and the 360-day divisor since you're trading the US index in USD I hope that it helps ! All the best - Arvin

-

Please see the expected dividend adjustment figures for a number of our major indices for the week commencing 16th August 2021. If you have any queries or questions on this please let us know in the comments section below. For further information regarding dividend adjustments, and how they affect your positions, please take a look at the video. NB: All dividend adjustments are forecasts and therefore speculative. A dividend adjustment is a cash neutral adjustment on your account. Special Dividends Index Bloomberg Code Effective Date Summary Dividend Amount TOP40 AGL SJ 18/08/2021 Special Div 80 UKX AAL LN 19/08/2021 Special Div 80 (Divi in US cents) RTY MNRL US 19/08/2021 Special Div 21 RTY HL US 20/08/2021 Special Div 0.75 RTY TAST US 24/08/2021 Special Div 41 How do dividend adjustments work? This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

-

inquiry : does IG platform could be downloaded on mobile ?

ArvinIG replied to Ahmad1258's topic in Foreign Exchange (FX)

Hi @dcy, That is the app for the Two factors of authentication. Unfortunately, as advised above , the IG app is not available in Taiwan. All the best - Arvin