-

Posts

1,728 -

Joined

-

Last visited

-

Days Won

23

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by ArvinIG

-

-

6 hours ago, Rawnuk7 said:

Apologies in advance if this question has already been asked, as this is a first for me.

Looking into buying shares and starting small. I guess on everyone on here are the big players.

Would be super helpful is someone can point me in the right direction in how to get started with shares trading.

Many thanks

-Rawnuk

Hi @Rawnuk7,

Thank you for your post and welcome to IG Community. On the Community there is all types of traders and different level of experience, beginners are more than welcome.

Feel free to go through the the IG Academy it might gives you some information on share trading, it is a free educational tool provided by IG:

https://www.ig.com/au/learn-to-trade/ig-academyYou can also have a look at the page below, it contains several articles that you might need useful.

https://www.ig.com/uk/trading-need-to-knowsIf you have specific questions feel free to post on the IG Community.

All the best - Arvin

-

2 minutes ago, Marius1 said:

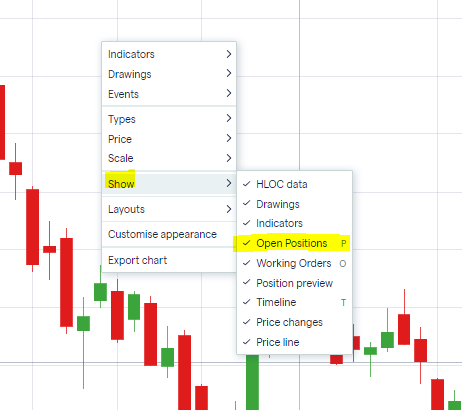

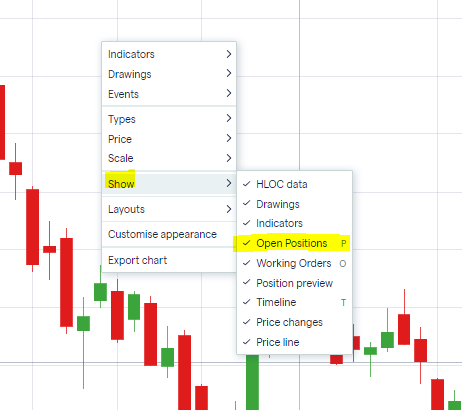

I cannot see an open postition on a chart - where do I get technical help to fix the platform?

Hi @Marius1,

Thank you for your post.

Please ensure that chart is setup to show your positions by right clicking on the chart > Show:

If your open positions are still not showing please reach out to helpdesk.za@ig.com.

Thank you - Arvin-

1

1

-

-

3 hours ago, Thoughtsofmoog said:

Hi all - i've searched, but afraid I can't find a simple answer to this, despite watching the videos.

I can't seem to find the option to set a stop loss for simple share dealing, which is weird and I expect user error.

I can see it in the spread betting account, but not share dealing.

Any advice would be appreciated.

Hi @Thoughtsofmoog,

Once the market is open on the deal ticket you should be able to change the order type to stop order:

Could you please advise which stock you are after?

Thank you - Arvin -

11 hours ago, ANYCAST666 said:

How long does it take IG to verify an account after all documents has been submitted as a client from Ghana

Hi @ANYCAST666,

Thank you for your post.

Once your documents are received and verified you should allow few more business days before you can deposit funds and trade. The Account opening team or your account manager will be in touch with you.

All the best - Arvin -

4 hours ago, LiamWhite said:

Name Of Stock - Solo Brands Inc

Name of Stock Exchange - NASDAQ

Leverage or share dealing - Share dealing

Ticker - DTC

Market cap - £403.5

Hi @LiamWhite,

Thank you for your request.

It has been submitted to the dealing desk to be added.

All the best - Arvin -

GOLD, XAU/USD, SILVER, XAG/USD, TECHNICAL ANALYSIS, RETAIL TRADER POSITIONING - TALKING POINTS

- Fundamental analysis hints gold, silver may continue falling

- Retail trader bets offer upside view on gold, downside for silver

- How are technicals aligning with the fundamentals, positioning?

Gold and Silver prices have been struggling to find upside momentum in recent weeks amid global efforts from central banks to tame high inflation. This is making for a difficult fundamental environment for these anti-fiat precious metals. How have retail traders been positioning themselves in XAU/USD and XAG/USD amid recent price action and what could that mean for the road ahead? For a deeper dive into the analysis, check out this week’s webinar recording above.

GOLD SENTIMENT OUTLOOK - BULLISH

The IGCS gauge shows that about 81% of retail traders are net-long gold. IGCS tends to function as a contrarian indicator. As such, the fact that traders remain net-long hints prices may continue falling. However, short bets have climbed by 2.2% and 20.32% compared to yesterday and last week respectively. With that in mind, recent changes in sentiment warn that gold could reverse higher.

XAU/USD DAILY CHART

On the daily chart, XAU/USD remains in a downtrend since early March, but recent price action is looking neutral. The yellow metal appears to be consolidating between resistance (1869 – 1879) and support (1787 – 1810). In fact, it seems that gold could form a Bearish Rectangle. Breaking under the range of support could be a sign of downtrend resumption. That would place the focus on lows from December. Otherwise, pushing above resistance could shift the outlook increasingly bullish.

SILVER SENTIMENT OUTLOOK - BEARISH

The IGCS gauge shows that roughly 95% of retail investors are net-long silver. Since nearly the absolute majority of traders are positioned to the upside, this is a sign that prices may continue falling. Downside exposure has been falling recently, declining by 12.79% and 33.92% versus yesterday and last week respectively. With that in mind, the combination of current readings and recent changes in IGCS hint that Silver may remain biased to the downside.

XAG/USD DAILY CHART

Similar to gold, silver prices have been in a downtrend since early March. Recent price action has been looking neutral as well. A Bearish Death Cross remains between the 20- and 50-day Simple Moving Averages (SMAs), offering a downside bias. Key support seems to be the May low at 20.46. Clearing the latter exposes the midpoint of the Fibonacci extension at 19.63. Otherwise, clearing resistance (22.20 – 22.51) opens the door to a bullish technical outlook.

*IG Client Sentiment Charts and Positioning Data Used from June 21st Report

Daniel Dubrovsky, Strategist for DailyFX.com

22 June 2022To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

-

12 minutes ago, LordStewart1963 said:

I can only access a demo CFD account. I have tried everything but cannot seem to be able to set up a share account.

Hi @LordStewart1963,

Thank you for your post.

There is no Share dealing Demo account, only CFD and Spread Betting.

Thank you - Arvin -

7 hours ago, User2022 said:

I have very similar issue.

I contacted helpdesk by email, phone for 4 months and still no reply and explanation when it would be possible to use my account for trade or withdraw funds.

Please help to resolve the situation.

Hi @User2022,

Thank you for your post.

You will need to reach out to the Helpdesk with your registered email address.

Did you open an account recently and are waiting for your account to be activated?

Thank you - Arvin -

51 minutes ago, ChristianJS said:

Hi Arvin, I followed the above steps and when I set the book cost to zero, it tells me to enter a valid book cost and it is not allowing me to save it.

Hi @ChristianJS,

Apologies for the confusion, you will need to set the book cost to the price you initially paid the stock. If you initially paid USD 100 for the stocks for example, you will need to set the book cost at 100.

Thank you - Arvin -

3 hours ago, ChristianJS said:

Hi Anda,

Thank you for your response. It makes sense that I received 3 shares of WBD as I have 16 shares of AT&T (and still do) but what does the 3 shares of WBD mean as they have zero book cost/average price? Am I right in saying that the 3 shares of WBD in my account has no value since I didn't purchase them? In that case, how do I remove the 3 shares of WBD from my account (since I still have my AT&T shares)?

Hi @ChristianJS,

On the system the Corporate action team need to sell and buy stock at the price of 0 to go through.

You will need to edit your book cost for the P/L to display correctly.

you can find the steps on how to edit your book cost here:

https://www.ig.com/au/help-and-support/investments/share-trading/how-do-i-edit-my-book-cost

I hope that it helps !

All the best - Arvin -

4 hours ago, Hedge99 said:

If I open a spread bet in Bitcoin this will give me investment exposure to Bitcoin, but does this avoid certain risks and other hassles were I to buy Bitcoin itself? For example I wouldn't be required to open a Bitcoin wallet, I would not need to worry about the counterparty risk associated with Bitcoin exchanges, I wouldn't have to worry about my wallet being hacked / frozen / locked or trading liquidity issues. Apart from the normal investment risk, is my only other risk that of credit risk to IG? Thing is though, is IG taking an exposure in the underlying which I will indirectly be exposed to if there is a problem.

Obviously I will need to upgrade my account to Professional status to trade in Bitcoin spread bets.

My first post on here. Thanks, Regards.

Hi @Hedge99,

Thank you for your post and welcome to the IG Community.

Effectively, you do not need hold a Crypto wallet to trade on Cryptos with IG. You are betting on price changes.

Something you may consider is the overnight funding:

"Our daily overnight funding rate is currently 0.0347% (12.5% per Annum) for bitcoin, 0.0417% for the Crypto 10 Index and 0.0556% (20% per Annum) for all other cryptocurrency markets. At present, clients with a long position will pay this overnight funding rate, while clients with a short position will receive on the overnight funding rate. In addition, a 7.5% per-annum IG admin fee will also apply for both long and short positions."

https://www.ig.com/uk/help-and-support/spread-betting-and-cfds/products-markets-and-trading-hours/what-are-igs-bitcoin-spread-bet-product-details

IG will hedge your exposure in the underlying market,so our interests are aligned with yours. you won't be exposed to IG exposure.

I hope that it helps !

All the best - Arvin -

36 minutes ago, ians33 said:

I need to print my end of financial statement, can someone help me with these steps ?

Hi @ians33,

Thank you for your post.

To access your yearly statements you will need to go on My IG > Live accounts > Statements:

Please ensure that in the 'You are viewing' section at the top, you are looking at the right account.

You will find you previous statements if you received dividends in the past. You can download the statements and print them.

I hope that it helps

All the best - Arvin -

On 18/06/2022 at 07:58, Profanello said:

Hi

I haven't been able to find any information on this so here are my questions:

When you start closing positions after a margin call when equity drops below 50% of margin requirements:

- Do you first close limit orders that haven't been opened yet rather than open positions?

- Do you close order by order or all positions at once?

So my example is, I'm nearing 50% but have a number of limit orders that haven't been triggered/opened yet. Without those I have plenty of equity left for my live trades.

Thanks

Hi @Profanello,

Thank you for your post.

Your positions will be closed on a First in First out (FIFO) basis, meaning we will close the position by order not all of them.

We will not close your open orders, otherwise you will miss out on opening position on markets you wanted too.

You will receive warnings as explained in the link below. You can close your open orders if you like to avoid closing open positions.

What is margin call? | IG UK

I hope that it helps !

All the best - Arvin -

On 15/06/2022 at 21:46, kiabosh said:

I've watched the help videos and the options they describe don't seem to be available to me.

One video shows an option to switch stops on in the settings menu but that is not available either.

I'm sure I'm missing something very simple here.

Thanks

On 18/06/2022 at 18:22, Skyfall77 said:Not in isa, but Having same issue, can’t find way to apply stops on US equity held.

Hi all,

Unfortunately, you can only add stops on existing position with leveraged accounts like a CFD account.

You will need to place the stop/limit when placing the deal.

I hope that it helps.

All the best - Arvin -

On 18/06/2022 at 21:58, EmilyD said:

Hi all!

I am currently trading CFDs on the ASX market. I have two $5 contract (longs) as well as five $1 contract (also longs) on. Due to the current market sentiment I will need to hedge soon - putting some shorts on - to try and balance my longs out in case the market dips more. Here is my question: even though I have $5 and $1 contract on (so 2 different charts) do i have to split my shorts on those 2 charts or if I put all my shorts to hedge on the $1 chart it will automatically apply for the $5 chart as well?

I hope I am not too confusing ...

Thanks!

Hi @EmilyD,

Thank you for your post.

You will need to open opposite trades in on same market and quantity. $5 contracts and 1$ respectively.

Make sure that you are using force open and not net off, otherwise it will close your existing position to open a new one:

More information on Force open here:

https://www.ig.com/au/glossary-trading-terms/force-open-definition#:~:text=What is force open%3F,position on the same asset.

I hope that it helps.

All the best - Arvin -

On 18/06/2022 at 18:19, Skyfall77 said:

U.K. investor .. Where can I find a list of US funds I can buy on IG please?

Hi @Skyfall77,

You can use the ETF Screener to go through the different ETFs available:

https://etfscreener.ig.com/?cols=AssetClass,Currency,NetAssets,PrimaryExchange,ReturnM12&filters=GlobalSector,ISA,LeveragedFund,UCITS&map=null&page=1&sortCol=NetAssets&sortDir=-1

I hope that it helps.

All the best - Arvin -

On 18/06/2022 at 11:11, discodisco200 said:

Hi! Just logged it in to my account today and it's showing 0 balance and all my holdings have vanished. Is anyone else having the same issue?.

Hi @discodisco200,

Thank you for your post.

It is possible that your balance was showing the wrong amount as during weekends IG performs backups. The maintenance usually ends at 1pm AEST.

Please let us know if it is showing properly now.

Thank you - Arvin -

On 18/06/2022 at 19:34, JohnD22 said:

OK. I spoke too soon! Looks like it is back up and running... for now.

Hi @JohnD22,

Thank you for your post.

Cryptocurrencies markets close at 10pm on Friday night (UK time), then reopen on Saturday at 8am (UK time).

On weekends IG performs backups, it is possible that some maintenance are longer that other, hence delays.

I hope that it helps.

All the best - Arvin -

7 hours ago, ChrisHewlett said:

Hello everyone, I’m new here on the IG Community chat so just thought I’d say hello.

where is everyone from here in the UK? 👍🏻📈📊📉

Hi @ChrisHewlett,

Thank you for your post and welcome to the IG Community !

All the best - Arvin-

1

1

-

-

On 18/06/2022 at 01:34, Tony said:

Hi Arvin, thanks very much for your answer. Just one more thing would you know if this is on all trading platforms including in the US or just certain brokers that would list this stock as a fledgling company and not borrow stock as there isn't much interest from their clients?

Thanks very much.

Hi @Tony,

I am not sure about the US as we only offer Forex for US clients.

As for other brokers, I believe that it is a business decision based on their dealing desk, risk appetite and exposure.

Thank you - Arvin -

42 minutes ago, JDubyaTas74 said:

I apologise if this is a silly question but if I place a single sell order for a parcel of shares but the sale occurs over a number of days due to low volume, is there a brokerage charge for every time there is a sale from that one sales order? (ie the order takes 3 days to complete I get charged a fee for each parcel that is sold down)

This doesn't seem reasonable but appears to have occurred to me on some recent sales?

Hi @JDubyaTas74,

Thank you for your post.

Effectively the commission is charged per trade. You can change your Expiry so have only one trade when the quantity is available. It is likely that you used the Good till canceled, which fill the order when available and keep the order active until filled or when you cancel that order.

I hope that it helps !

All the best - Arvin -

1 hour ago, AlexI25 said:

Candle remaining time is a must! Please add this feature as it has been requested multiple times. It should not be very difficult to add. Please!

Hi @AlexI25,

Thank you for your feedback, it has been forwarded to the relevant department to be reviewed.

Thanks - Arvin -

U.S. stocks erase Wednesday’s gains and turn sharply lower; the S&P 500 plummets more than 3% and hits new 2022 lows and selling activity on Wall Street appears to be triggered by fears the U.S. economy is headed for a recession.

Source: BloombergBullish sentiment didn’t last long on Wall Street. After Wednesday’s brief relief rally, U.S. stocks took a sharp turn to the downside Thursday, with most sectors selling off violently amid growing recession anxiety. At the time of writing, the S&P 500 has given up all of the previous session's gains and more, losing roughly 3% and setting a new 2022 low around 3,660.

Yesterday, the Fed raised its benchmark rate by 75 basis points to 1.50-1.75%, delivering its largest hike since 1994, but the forceful measure failed to spark a negative reaction as Chair Powell clarified during his press conference that moves of that size would not be common.

By not endorsing an uber-hawkish approach, Powell calmed some nerves temporarily, but the mood has soured again as traders begin to acknowledge that the central bank’s remains on course to remove accommodation aggressively over the forecast horizon. For context, 150 basis points of additional tightening is expected for the remainder of the year. This should take the federal funds rate above neutral and into restrictive territory late in 2022, creating headwinds for risk assets.

Restrictive monetary policy at a time of slowing activity will become an additional drag on economic growth, increasing the likelihood of a hard landing in the medium term. Recession fears were heightened this morning after interest rates on 30-year mortgages in the U.S. soared to a nearly 14-year high of 5.78% and May new-home construction plunged 14.4%, sinking to the lowest level since April 2020, a clear sign of trouble for the housing sector.

Looking ahead, there is little reason to be optimistic about the outlook for the S&P 500 for now. While bear market rallies are difficult to time and cannot be ruled out, the overall trading bias remains tilted to the downside for the world’s top equity index. That said, the next significant leg lower could develop soon if U.S. companies begin issuing negative profit warnings ahead of the second-quarter earnings season. Traders should pay close attention to any guidance offered in the coming days to gauge the strength of Corporate America amid weakening GDP growth, inflation headwinds and tighter financial conditions.

S&P 500 technical analysis

Wednesday’s rally was nothing but another dead-cat bounce. Today, the S&P 500 is down more than 3% and has broken below channel support at 3,735/3,700, though the trading session is not yet over. If prices close below this area on Thursday, the next downside focus shifts to 3,500, a key floor created by the 50% Fibonacci retracement of the 2020/2022 rally. On the off chance of a rebound, initial resistance appears at 3,810, followed by 4,000.

S&P 500 technical analysis

Source: TradingView

Source: TradingView

IG Analyst

17 June 2022This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

-

7 hours ago, RobJ said:

I am perplexed by the charges IG seem to conjure.

On one overnight trade I get a .70p interest charge....... and yet on another identical trade (i.e. Same quantity and just one overnight held position) I get a £9.87p interest charge.

IG chat help just tells me overnight charges are not fixed charges (interesting use of words!).

When pressed on this matter, the chat is cut off telling me "I am unable to provide you the information/assistance right now. However, I will get back to you with an email at the earliest".

All I need is a clear and reasonable explanation.

All answers gratefully received.

Hi @RobJ,

Thank you for your post.

It is likely that you were charged for the weekend if you are trading FX.

Spot FX in the underlying market usually works on a T+2 basis, meaning settlement/delivery 2 working days after the trade takes place. Because of this, the weekend interest (3-day charge) is charged if you held a position through 10pm on a Wednesday rather than through market close on Friday.

I hope that it helps !

All the best - Arvin

Spreads for stocks

in Shares and ETFs

Posted

Hi @ZR_,

You can find the similar page of Shares and ETFs here:

https://www.ig.com/uk/help-and-support/spread-betting-and-cfds/products-markets-and-trading-hours/what-are-igs-shares-spread-bet-product-details

Thank you - Arvin