-

Posts

1,728 -

Joined

-

Last visited

-

Days Won

23

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by ArvinIG

-

-

26 minutes ago, RFSmithers said:

Is it possible to stop or change the frequency of the "Daily Trading Report/Statement" received through email? Can it be disabled completely or the timeframe changed (weekly/monthly)?

Hi @RFSmithers,

You can change you dealing alerts on My IG > Settings > Price & dealing alerts:

I believe that you will only receive the daily statement if you traded on that day. We are required to send you a statement for the day for compliance purposes.

I hope that it helps.

All the best - Arvin

-

1

1

-

-

7 minutes ago, elbak283 said:

Thanks for that Arvin.

So I was looking in the wrong place for information on how to calculate overnight funding interest on Australian cash market index CFD's. Instead of using the rules on the page "Why is overnight funding charged and how is it calculated?", I should have been using the rules on the page "What are IG's indices CFD product details?" in a side tab in the middle of the page, in the 7th note in that tab.

I don't know how I feel about that. I feel like it was reasonable for me to look for information on how to calculate overnight funding interest on the page "Why is overnight funding charged and how is it calculated?", and rely on that information.

I clearly made a mistake here, but if I'm honest I feel like I don't know how to avoid more mistakes, and incurring more unexpected charges, without reading every single thing, and every little detail, on the website.

Hi @elbak283,

I apologise for the confusion, I will forward your feedback to the relevant department to be reviewed.

All the best - Arvin -

22 hours ago, dex47 said:

could someone answer me a question about share buying around the time of a company going ex dividend? I wanted to sell some Natwest shares on 13th August which was the day they went ex dividend. I rang customer helpline to ask whether I would still get the dividend if I traded on that day. I was told I would still get the dividend so I sold the shares. I had some doubts because of the language difficulty so I rang again and spoke to another operative who said I would only get the dividend if I still held the shares at the close of business on that date (13th) and therefore I would NOT get the dividend. He apologised for the earlier advice which was wrong. He said if I sold any shares in the future I should deal several days before the ex dividend date to make sure I did not loose the dividend. I am confused what to do in the future and am most concerned when I cannot trust the advice given on the helpline

HI @dex47,

You will need to hold the shares on ex-date to be eligible for the dividends. If you sold you shares before ex-date you won't be eligible for the dividends.

More details here.

"Companies can pay several dividends a year. Prior to each dividend payment date, the company will set a record date — the date on which a shareholder must be recorded as such and therefore be eligible to receive the dividend payment. Once the record date has been set, than the ex-dividend date is set. It is typically a couple of days before the record date, but the exact timing depends on the rules of the stock market on which the company’s stock is listed. It becomes a marker date for investors. When buying stock, it normally takes about three days for the purchase to be settled and recorded and therefore investors know they must buy stock before the ex-dividend date if they are to get the next dividend payment by that company".

I hope that it helps.

All the best - Arvin -

21 minutes ago, elbak283 said:

Hi,

Last Friday, I wanted to hold an index CFD cash short for a longer period of time, so I closed the short and immediately opened a short CFD futures on the equivalent index for the equivalent exposure. I did this because I specifically wanted to avoid overnight funding interest charges, which according to IG's website, will apply in the following circumstance:

"Please note that open positions held through 10pm (UK time) on Fridays will be adjusted for three days’ worth of funding to cover the weekend."

I had taken out 40 US 500 Cash (A$1) short contracts at the beginning of the week last week, and closed it out on Saturday 14 Aug at 2:11 am Australian Eastern Standard Time. This is approx Friday 13 Aug at 5:11pm in UK time (Australia is approx 9 hours ahead of the UK). The short was the only active position on my CFD account. I then opened a short SEP-21 futures contract.

I went to bed thinking that because I closed my position 4 to 5 hours before the 10pm Friday UK time cut-off date, I had avoided overnight interest charges.

This morning, I go to check my transaction history, and find that I've been charged A$43.20 under description of "short interest for 13/08/21 to 15/08/21".

Can anyone help me understand why I've been charged overnight funding interest for 3 days, when I closed my index CFD on Friday afternoon UK time? I thought I did everything right - switching to futures from cash contracts before the cut-off time avoid overnight funding, but apparently this is not the case.

Any help appreciated.

Hi @elbak283,

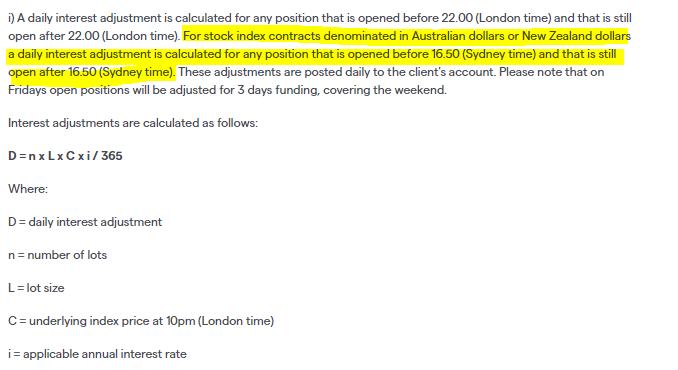

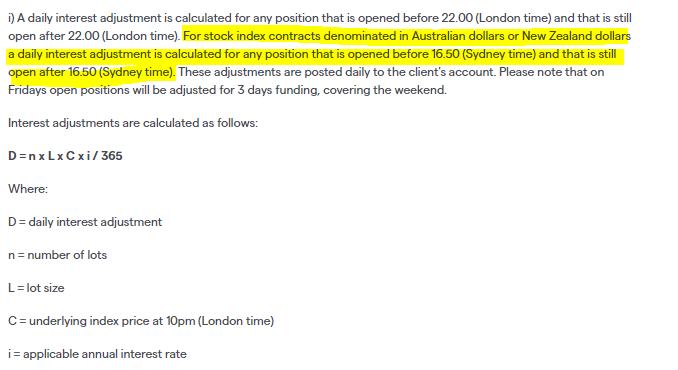

https://www.ig.com/au/help-and-support/cfds/fees-and-charges/what-are-igs-indices-cfd-product-detailsIn the Notes paragraph 7 :

For stock index the cut-off time is 4.50 PM AEST. That would explain why you have been charged that amount.

I hope that it helps !

If you have furhter questions please reach out to helpdesk.au@ig.com.All the best - Arvin

-

2 hours ago, MikeK said:

When is the 2021 EOFY report due to be released?

Hi @MikeK,

Are you referring to the EOFY statements? They have been released 3 weeks ago. You should be able to find it on My IG > Live Account > Statements. A statement will be issued if you received dividend during that financial year.

If you need further assistance please reach out to helpdesk.au@ig.com

All the best - Arvin -

On 14/08/2021 at 02:45, nit2wynit said:

Hi, thanks. I use Chrome already. I Trade very day and have done for 2.5 years. Nothing is new.

If no others are reporting problems I'll assume it's my end and see if it resolves.On 14/08/2021 at 10:56, Guest Having the same problem said:Hi @nit2wynit,

You can try to clear the cache and cookies on Chrome. If the issue persist please email helpdesk.uk@ig.com with a screenshot. The IT team will investigate the matter for you .

All the best - Arvin -

On 15/08/2021 at 02:02, Guest Suhail said:

Are your stocks and shares ISA Flexible?

Thanks.

Hi Suhail,

Some stocks won't be available on your ISA account, you will see the error message :"instrument not tax wrapper enabled"

If that's the case you will only be able to trade the stock on a share dealing account.

All the best - Arvin -

1 hour ago, seyd said:

How Can I Determine The Leverage Of My Account ??!!!

Weird Thing!! When I Can`t Control Determine The Leverage In My Account ? .

HI @seyd,

I have already replied to your previous post.

Unfortunately, you can't change the margin requirement they are fixed percentages.

Please read through https://www.ig.com/en/cfd-trading/charges-and-margins.

If you have any further question please reach out to helpdesk.en@ig.com

All the best - Arvin-

1

1

-

-

On 15/08/2021 at 06:25, rammy1964 said:

I would like to be certain either way and cnt recll the answer to this.

If I acquire shares in a US company through IG do I actually own those shares and can i have them registered in my name directly with the company / Computashare as I intend to hold for the long term? Thus benefitting from any dividends in whatever format - not cash equivalents.

TIA

Hi @rammy1964,

IG operates under a custodian model,shares purchased are held by Citi in a direct custody capacity. The clients are the ultimate beneficial owners. You will receive dividends and be eligible to participate in any corporate actions such as rights issue.

If you need further information please reach out to helpdesk.uk@ig.comAll the best - Arvin

-

On 15/08/2021 at 08:22, cperrie1 said:

I also have a similar queston. Newbie demo account that I would like to change from CHF to GBP as the demo currency as my future live account will be UK based. I couln't find a customer service e-mail address, please could you advise me.

Thanks Chris

Hi @cperrie1,

Our helpdesk email address is helpdesk.uk@ig.com. Please send your request to this email address with your account details.

All the best - Arvin-

1

1

-

-

-

On 08/08/2021 at 18:53, sbre3903 said:

Hi there - Id like to invest in the US Stock - "UP Fintech Holding Limited (TIGR)" via my ISA.

When I go to place an order I receive the notification that this share is an "instrument not tax wrapper enabled" . Is there anyway I can invest in this US stock via my ISA and if not, why can Iinvest in some US stocks via the ISA and not others?

Any help would be super appreciated

-Thanks Sam

On 13/08/2021 at 18:01, mcowen said:Having the same issue - if you or anyone has an answer would be good to know.

Hi @sbre3903 @mcowen,

The "instrument not tax wrapper enabled" means that you can't trade this stock on a ISA account. You might be able to trade on a Share Trading account.

If you need more information please reach out to helpdesk.uk@ig.com.

All the best - Arvin

-

5 hours ago, seyd said:

how can i change the leverage of my live accounts ???

Hi @seyd,

Unfortunately, you can't change the leverage on your transactions. You can find the margin requirements on the "info" tab on the deal tickets :

All the best - Arvin

-

10 hours ago, ReenaVerma said:

Hi There,

I setup a trading account with ig.com this afternoon, so I could specifically trade shares on ASX.

As I'm a new user and never used ig.com before, I wanted to test deposit a small amount of money into my account.

1. So I typed in £100 and attempted to deposit this much from my bank card. I was alerted with a message/prompt, which stated I need to withdraw £250 as a minimum.

2. So I then tried to withdraw £250. And the ig.com web page, when wanted me to open my mobile app to approve the purchase.

SCREENSHOT BELOW, (cropped to remove my account id).

To my horror, I instantly saw when I logged in that ig.com had attempted to withdraw £2,500 from my bank account!!! I "cancelled" the deposit immediately, however this is showing as "pending" still with my bank.

Has this happened to anyone before? I am nervous and worried about depositing money into ig.com, as my first experience with them so far has been not good.

To make things worse, I called up up ig.com customer services and the advisor told me, that "I" had apparently attempted to deposit £2,500 twice myself. And the only way I could have done this, is by typing in 2500.

I told him this is not true and I have a screenshot, with my account id included, which clearly shows 250.00 GBP.

So far, I'm super concerned that IG systems have logged 2 "transactions". Which both were no £2,500.

The customer service guy didnt even want to see my screenshot. He confirmed both transactions have been cancelled. And I've asked my bank to not let this pending transaction process.

However, so far ig.com website seems highly untrustworthy.

Has anyone else experienced similar issues today?

Hi @ReenaVerma,

1. The minimum deposit of GBP 250 is normal, it is stated on the deposit funds page next to the field where you enter the amount :

2 . The page that comes up to verify/confirm your transaction is not managed by IG. It is your bank pop-in a verification window.

It is possible that you made a typo on the amount the first time.

There are 2 declined transaction on your account on for 250 one for 2500.

I would recommend to call us on 0800 195 3100 while you are trying to make a deposit for live assistance.

Card payments are immediate, if there is no amount on your balance it would mean that they were declined. Your bank might take a day or two to change the pending status on their end.

I hope that it helps.

All the best - Arvin

-

On 14/08/2021 at 19:42, TCTIII said:

Hi,

I have just opened an account. Can someone tell me please if it is possible to buy shares on the Oslo exchange through IG? If so, where do I click? It wasn't immediately obvious to me, and the share I want doesn't come up in a search (TGS.OL) so am now thinking it may not be possible. If not then any recommendations for other platforms that will allow me to do that?

Cheers

Tom

Hi @TCTIII Tom,

We do offer TGS.OL on our platform. The stock is only available on Leveraged account ( CFD - Spread Betting).

We created a specific thread for stock request here.

For Share trading accounts, stocks from these countries can be added

I hope that it helps - Arvin -

On 14/08/2021 at 04:12, CassiusWest said:

Hello I am new to IG and I’m at the stage of waiting for verification for my account to be activated. I’ve uploaded my ID and it’s been approved yet my account is still not activated. Any help?

Thank you, Best regards

Hi @CassiusWest,

Once your documents are uploaded and verified the account opening team will finalise your application. For updates on your application please reach out to newaccounts.uk@ig.com.

All the best - Arvin -

On 19/01/2021 at 05:12, IanB1000 said:

How do i change time frames on the phone app?

3 hours ago, Guest DDD said:Was this ever answered? I have the same question.

Hi,

On the App once you are on the chart if you tap in the middle once a menu should appear with the option to change the interval, indicators etc.

All the best - Arvin -

On 14/08/2021 at 13:41, MFRAGLER711 said:

Arvind

Helpdesk sent only CFD statement not the share trading. I really want to pull out of IG this year as it is such a nightmare to get a statement. I sent a request helpdesk as well but no respond

Hi @MFRAGLER711,

I have sent you out a statement for your Share Dealing account.

I hope that it helps.

- Arvin -

19 minutes ago, Tipper258 said:

Issue 1. The API does not behave as documented

The streaming API does not behave like the documentation, it never raises a WOU, always an OPU and it can have 2 different bodies. You have to inspect the body for presence of certain properties to determine what type of message it is. No biggie, can work round this once figured out this is what happens in both demo and live spread bet accounts.

Issue 2. forceOpen behaviour

Having used IG for many years, I'm very familiar with the web platform behaviour of forceOpen. Set it to true and your working order doesn't impact existing orders when the order executes. Set it to false and the order will apply to any open position in the same epic, quite how it decides which position to impact if you have multiple open is unknown.

In the REST API, the documentation says the default for forceOpen is true for working orders. Certainly if I try to set it to true I get a 400 with invalid.forceOpen error. If I don't set it, when the order is executed it behaves as if it were set to false and closes open positions which is rather unhelpful for the strategy.

When using the API companion, and I paste in the exact request body, with forceOpen set to true, it doesn't complain, off it goes and creates a working order. Mind you it returns the dealRef I specified but doesn't create the order with the dealRef which I guess is an implementation 'thing' with the companion, but then again that says maybe it actually strip out the forceOpen true before making the real API call too? Hard to know, or have confidence it's a true reflection of the real call.

This one I can't test in live, it costs real money with this behaviour, I'm unable to create a working order with forceOpen set to true, and the behaviour without it is as per false, despite the documentation saying it's true. I can't find a workaround.

How do I get support on this from IG, and bugs fixed or ultimately debug how this is my problem? Having been a developer for way too many years I'm conscious you can be very confident in your code only to find out you did get something wrong. For me the code works perfectly, a fairly complex strategy, until I add in the "forceOpen": "true" and get the 400.

Or is this 'just how it is' with the IG API? Thanks!

Hi @Tipper258,

The best way to get some support with API would be to reach out to webapisupport@ig.com.

All the best - Arvin-

1

1

-

-

9 minutes ago, dcy said:

Thanks Arvin,

Do this mean that customers in Taiwan are not able to use IG mobile app for Trading? I just open an account with IG without noticing this.

This will be a very negative concern considering what IG has promoted in doing, will IG be solving this issue?

Thanks.

Hi @dcy,

I will forward your concern to the relevant department to add the iOS app for clients in Taiwan.

All the best - Arvin -

7 hours ago, Ranks007 said:

Does anyone know how the stock borrowing costs are calculated on say Qantas when you short via cfds..

Hi @Ranks007,

You can find how the borrowing cost on this page here.LIBOR is calculated according to the currency of the underlying instrument.

If you’re long, you pay LIBOR (or the equivalent interbank rate). If you’re short, you receive it.

Formula: Number of contracts x value per contract x price x (2.5%* +/- LIBOR%*) ÷ 360

Example:

1) You’re long 1500 contracts on Commonwealth Bank of Australia

The contract value is AUD 1

The closing price is 83.90

The 1-month AUD LIBOR rate is 1.89%

Cost = 1500 x 1 x 83.90 x (2.5% + 1.89%) ÷ 360

= A$125,850 x 4.39% ÷ 360

= A$15.35 overnight charge2) Imagine you’re short 2 contracts on the US Tech 100. The contract value is $20.

The 10:00 PM (UK time) price is 13200.00. The 1-month US LIBOR rate* is 0.11%. Our admin fee is 2.5% annually.

Cost = 2 x $20 x 13200 x (2.5% - 0.11%) ÷ 360 = $528,000 x 2.39% ÷ 360 = $35.05 overnight charge.

*We use US LIBOR and the 360-day divisor since you're trading the US index in USD

-

5 minutes ago, dcy said:

Hi @dcy,

That is the app for the Two factors of authentication. Unfortunately, as advised above , the IG app is not available in Taiwan.

All the best - Arvin

-

54 minutes ago, dcy said:

Hi @dcy,

Unfortunately the IG app is not available on the App store in Taiwan.

All the best - Arvin -

42 minutes ago, dcy said:

Hi @dcy,

MT4 is a third-party software that we use, but it is not our app.

It should look similar to this :

I will try to get more information on the App store in Taiwan.

- Arvin

App push notifications not working

in IG Technical Support - Platform and App Help

Posted

Hi @DoubleThinker,

We are sorry to hear that you are facing a technical difficulty. I will forward your message to the relevant department to be fixed.

All the best - Arvin