CharlotteIG

-

Posts

1,702 -

Joined

-

Last visited

-

Days Won

20

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by CharlotteIG

-

-

On 29/08/2019 at 22:48, DanT said:

Ha, this is embarassing... It was my bug - there was a typo in the script I used to save the data from the API to disk to reuse 😁

No problem, glad it's all working for you now

-

On 26/11/2019 at 22:15, Domin said:

Hi,

How can I stream more than 40 Epic items?

Thanks,

Dominik

The API community would be the best place to check:

-

19 hours ago, Coombsy said:

Hi IG,

just wanted to say thanks for finally having a trade analytics sections as i am finding it helpful. knew you should always keep yor own records but often forget or i lose some info to mess up the totals so this has been helpful to know that all my trades are included.

thanks again,

Darethc

Apologies for the late response. We're in the initial beta launch phase and that we'll be rolling out more functionality and improvements. As we're still in the testing phase, not all clients will have access yet but it will be available to everyone in the coming months.

The project manager informed me of some options they're looking into going forward. Do keep in mind that these are not definite but I wanted to share the future options they're considering:

-

Ability to tag individual trades

-

We're discussing showing a chart of the underlying during the lifetime of the trade

-

Chart your PnL over time

-

The ability to drill into markets to see a trade by trade breakdownIf you have any suggestions @Coombsy, let me know

-

-

-

People believed US would be strong today due to Trump confirming a good deal but now there's some confusing about the US-China trade deal.

He're a quick breakdown from Reuters:

-

Just as an update the fingerprint ID is looking to be added to the Android app January 2020.

-

On 11/08/2019 at 13:14, AleksL said:

Hello,

Firstly I want to say what an excellent platform IG is, I find it very accessible and intuitive.

My request is to have Expiry functionality added to Alerts - as is currently available in Orders.

In particular for Alert/Price/Price Level."As a User, I want to configure and set an expiry when creating alerts, in order to reduce irrelevant alerts triggering."

Background:

Without an expiry and assuming the symbol continues trading indefinitely, then price will eventually cross the alert even if long beyond the time frame of the intended setup.

Thank you for your consideration.

Regards

Aleks

Thank you for your feedback @AleksL, I will ask the developers for that to be added.

-

-

14 minutes ago, Caseynotes said:

Some pieces I picked out:

- A stronger pound hits overseas earnings, and could result in a tough day for miners like BHP Billiton and Rio Tinto, along with the pharmaceutical giants AstraZeneca and GSK.

- The FTSE 100 is set for a strong open this morning, as UK assets benefit from the election result and the China deal news.

- Key winners in the wake of the news will be UK-focussed stocks, with housebuilders in the frame for further gains, as the sector is supported by hopes of a return to UK economic growth and the removal of fears that a Labour government would impose a more punitive taxation regime.

- We should watch out for more international names that might struggle as the pound continues to strengthen. Sectors such as pharma and mining rallied on the day of the Brexit result as sterling weakened, but today the reverse could be in play.

-

1

1

-

Conservatives have secured a majority after winning their 326th seat. Awaiting full results.

-

1

1

-

-

3 hours ago, Richania said:

Hi All,

I want to buy some US shares in Apple, Disney, Alphabet etc, how do I know whether I am buying the stock that I want.

I cannot see any codes like you do on comsec that differentiate each company, do I just search for the name such as Disney and the Walt Disney Co comes up on the list?

Is this the main Disney company?

Can I see the code for each stock or not?

Any assistance would be much appreciated.

Hey @Richania, thanks for your message.

Our leveraged platform does not show company tickers. If this is where you're looking to trade you can type the company name or ticker into the search bar. There has been clients on community asking to add the ticket back into the leveraged platform and I am speaking with developers to get this added.

On non-leveraged accounts you can find the ticker in the get info section.

I hope this helps, if you need anything else @ me or quote my response.

-

Conservatives Party set to win UK election with a clear majority if the exit poll is something to go off.

Pound jumps more than 1.9%, highest level since June 2018.

-

Jeremy Naylor was thinking of doing an Elliot/Fibonacci video if the community would be interested?

-

2 hours ago, dmedin said:

There was a chap on not so long ago, I think he might also be on these forums.

We did a piece before about Elliot waves, I wasn’t aware he way part of the community as well.

-

11 minutes ago, Andybram said:

The first drop was bad news about oil quality in the latest well in Ghana, the second big one on announcing cancellation of the dividend. Does seem a bit of an over-reaction and I bought a small holding for a trust after the first drop. I plan to hold on long on those as the price has recovered somewhat in the past few days although I suspect it may be quite some time before it gets back to the price I bought at

Hopefully it pulls back up for you 🐮

-

1

1

-

-

3 hours ago, dmedin said:

@CharlotteIG If I sell a put, my maximum gain is the difference between my deposit and 0, but my maximum loss is unlimited and can potentially exceed my deposit.

If I buy a call, my maximum risk is my deposit but my maximum gain is unlimited.

So why would anybody choose to sell a put instead of buying a call?!!! Or have I misunderstood this ... i.e. nobody would initiate a position by selling a put, but the option to sell a put is there for those who initiated by buying a put?

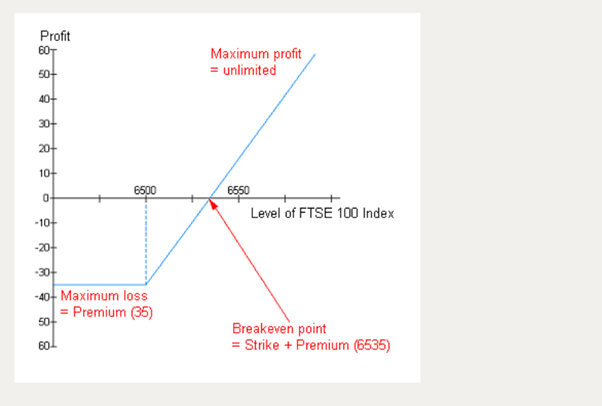

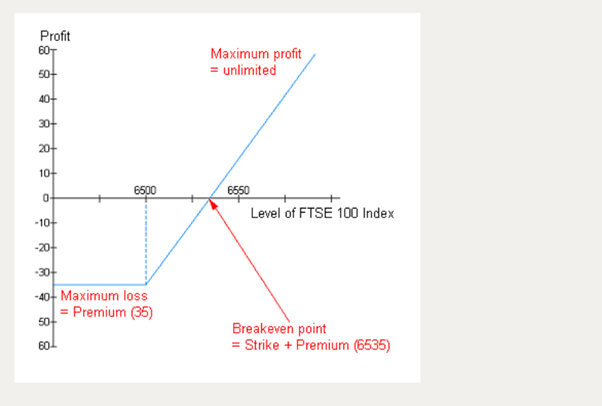

@dmedin- I luckily have a run down of the risks and rewards when selling a puts

Some people will sell calls/puts if they believe they're sure of the outcome so they can receive the premium. Buying calls though have limited risk and potentially unlimited profits.

-

1

1

-

-

DailyFX also have some guides if that would help but if you have some questions specifically I can see if our TV team can get a specialist in to discuss Elliot wave video.

https://www.dailyfx.com/free-trading-guides#beginnerGuides

-

On 03/10/2019 at 15:40, SkyTrader said:

Tired of the endless battles with your s/ware. Tired of the endless changes that invariable make the experience worse.

What is going on?

I can no longer see my balance in Safari and when I refreshed a window (rhs) it now has no template and I cannot even pull up the Apply menu for "save as/apply/delete" - it's totally unresponsive and all I have is a chart with candles ticks and no on chart and below chart indicators.

Tired of logging in on one window and never knowing if I'll get "go to platform" on the other 4 windows or not and have to log in separately. Tired of doing any changes that then REFRESH ALL the other windows.

Tired of the long phone waits to get through to support.

Apple have stated for the record Chrome is a memory hog. My activity app confirms this as since downloading it yesterday it's using 52% CPU for one of the 5 windows and 39% for the other --->>> RIDICULOUS. I have to have my Havit cooler fan turned on help cool this top of the range Macbook Pro as the fans are RACING.

So please tell me why you don’t cater to the biggest computer company in the world aka Apple? Tell me what's so good about those criminals at Google who have developed the most sophisticated piece of spyware the internet has ever seen?IG used to be a great company but I have already set up accounts with Saxo broker and may pull the plug after 10 years.

Hey @SkyTrader,

If it was lagging can you tell me how many tabs you had open for IG and what you needed them for. We do, like you said, advise clients to use Chrome because it is more compatible with our platform. If however, you want to use Safari you can email us and get some troubleshooting steps that should improve the speed.

If you could possibly get some screenshots of the issues that would be great to take to our projects team to better ourselves.

We really appreciate your feedback to help us look for solutions in the future.

-

19 minutes ago, dmedin said:

@CharlotteIG So what is the essential difference between

1) Buying a call/selling a put (betting on the price going up)

2) Selling a call/buying a put (betting on the price going down)

When buying a call/ selling a put you're betting on the market going up. If you're buying a call you have limited risk. The maximum you can lose is the deposit (premium). You've bought the right but not the obligation to buy at a certain price. Selling a put has max risk losses if the market hits 0.

When buying a put or selling a call, same principle applies. If you're buying a put you have limited risk. The maximum you can lose is the deposit (premium). You've bought the right but not the obligation to sell at a certain price. If you're selling a call all you can win is the premium from the buyer no matter how low the market goes. If you're selling a call all you can win is the premium from the buyer no matter how high the market goes. Meaning selling a call has unlimited losses

The margin when buying a call/ put is the maximum loss. The margin when selling put/call is the margin for the underlying market.

-

1

1

-

-

@dmedin Which point did you get back in, first dip or second:

-

1

1

-

-

Hey @dmedin, our analysts did a piece on this yesterday you might be interested in.

-

1

1

-

-

@jamesleo1 When buying a call/ put your maximum risk is the premium you put down. In the case below:

18 hours ago, jamesleo1 said:Lets Say the FTSE100 is trading at 7110. To buy a call at 7110 is 20, and the spread is 5. To buy a put at 7110 is also 20, and spread is also 5 (I am trying to straddle)

If you're buying a call at 7110, and the price is around there it means you're buying at the current price. Your break even point is 7130, (Strike + premium) if the market expires above that price you're in the money. If the price settle out of the money, the maximum you can lose is 20 x bet size.

If you're buying a put at 7110, and the price is around there it means you're buying at the current price. Your break even point is 6990, if the market expires below that price (Strike -Premium) you're in the money. If the price settle out of the money, the maximum you can lose is 20 x bet size.

Lets say you were doing £1 per point. If the market were to settle at 7110, you would lose the £20 on each, but if market settles either above 7150 or below 6970 you will lose £20 on one side but it would be outweighed by the profit on the other side.

^ Settling at 7150 you would have a £20 profitable position, but the lost on the other side (max loss of £20) ^

It's not about spread it's about finding the break even point using the price you paid for that option at the time. Below you can find some diagrams showing you how to work out break even points.

Let me know if you need anything else clarified.

-

1

1

-

-

2 hours ago, Guest Charlie said:

Thank you Charlotte. It's working as expected now. I did what you said so I must've done something wrong before. Thanks for looking into it for me.

No problem. If you want anything else let me know by @ me

-

Fed rate unchanged but USD Monthly Budget Statement (Nov) :

Prev: -$134B

Est: -$196.5B

Actual: -$209B

What is the USD doing?

in Foreign Exchange (FX)

Posted

I'll try and keep you up to date. With the US we have US Fed's Evans speech today at 17:40 GMT. Tomorrow the USD Initial Jobless Claims (Dec 13) is announced 13:30 GMT, prev 224K.